The latest snapshot on the UK housing market sees “significant downward pressure” on prices as mortgage costs rise.

The monthly report by Halifax showed just a 0.1% dip in prices last month from August but that the annual rate of growth had slowed from 11.4% to 9.9%.

Its commentary focused on tougher affordability amid the cost of living crisis.

It also, however, pointed to factors supporting prices including the shortage of new homes, strong wage growth and cuts to stamp duty revealed in the government’s mini-budget.

Cost of living and economy latest

The country’s largest mortgage lender said that predicting the path for prices ahead was tough given that the market has consistently outperformed expectations but the price trend suggested a downwards path in the short term due to affordability concerns.

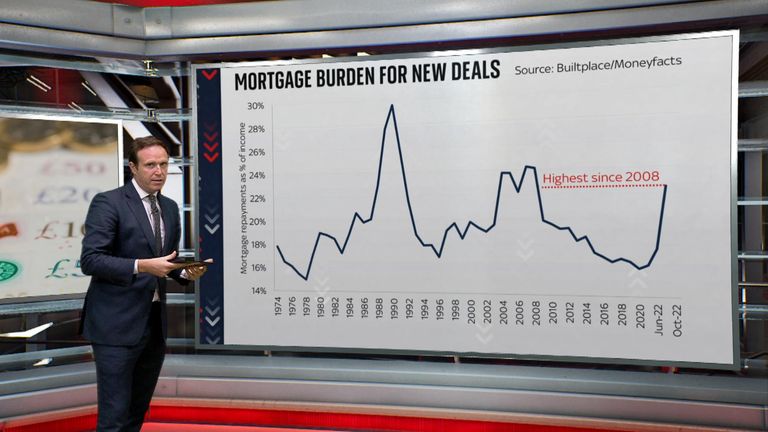

It spoke up after it was revealed that the average mortgage interest rate had risen to above 6%, according to data from financial information company Moneyfacts.

It means households are paying the greatest portion of their income on mortgage payments since 1989 at a time when the rate of inflation is running at a 40-year high.

The mortgage rate shift reflects a higher base rate of interest – currently at 2.25% – imposed by the Bank of England as part of its bid to tackle the surge in inflation mostly caused by the fallout from Russia‘s war in Ukraine.

However, market mayhem that followed the chancellor’s tax giveaway also prompted mortgage rates to rise as lenders, including Halifax, pulled products temporarily to ensure they reflected higher funding costs.

Kim Kinnaird, director of Halifax Mortgages, said of the market conditions: “The events of the last few weeks have led to greater economic uncertainty, however in reality house prices have been largely flat since June, up by around £250.

“This compares to a rise of more than £10,000 during the previous quarter, suggesting the housing market may have already entered a more sustained period of slower growth.

“Predicting what happens next means making sense of the many variables now at play, and the housing market has consistently defied expectations in recent times.

“While stamp duty cuts, the short supply of homes for sale and a strong labour market all support house prices, the prospect of interest rates continuing to rise sharply amid the cost of living squeeze, plus the impact in recent weeks of higher mortgage borrowing costs on affordability, are likely to exert more significant downward pressure on house prices in the months ahead.”