The Bank of England has warned against complacency after its interest rate was frozen at 5.25%.

Governor Andrew Bailey said he is determined to bring inflation back down to the target level of 2% – but with current rates at 6.7%, he added that “the job isn’t done yet”.

And amid speculation that the Bank’s base rate could now be close to peaking, he warned: “I can tell you we have not had any discussion on the Monetary Policy Committee about reducing rates because that would be very, very premature.”

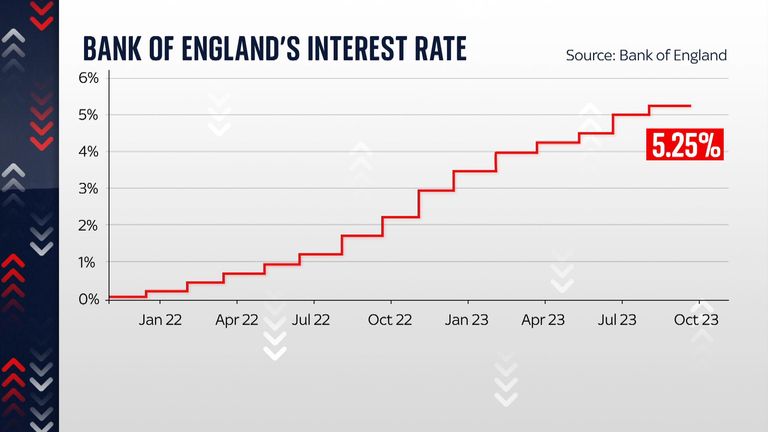

The decision to leave the interest rate unchanged came a day after inflation unexpectedly fell by more than expected – ending the longest successive period of “tightening”.

Before now, the Bank had raised rates 14 times in a row – and the last time they were left unchanged was in November 2021.

The Monetary Policy Committee’s latest vote was a narrow one – and while five members had voted in favour of a freeze, four had felt rates should rise further.

This breaking news story is being updated and more details will be published shortly.

Please refresh the page for the fullest version.

You can receive breaking news alerts on a smartphone or tablet via the Sky News app. You can also follow @SkyNews on X or subscribe to our YouTube channel to keep up with the latest news.