Volkswagen Group is reportedly pausing previously laid out plans for battery plants across Europe as it awaits the EU’s response to the Inflation Reduction Act in the US, which could offer the Group up to $10.5 billion in incentives. For now, Volkswagen will continue it progress in choosing a location of a US battery plant while it awaits what sort of conditions and/or incentives will come into play in what is being called the “EU Green Deal.”

Unlike other German automakers currently at odds with the EU Commission over the impending ban on new combustion vehicle sales by 2035, Volkswagen Group has instead doubled down on electrification and even increased its sales targets for passenger EVs.

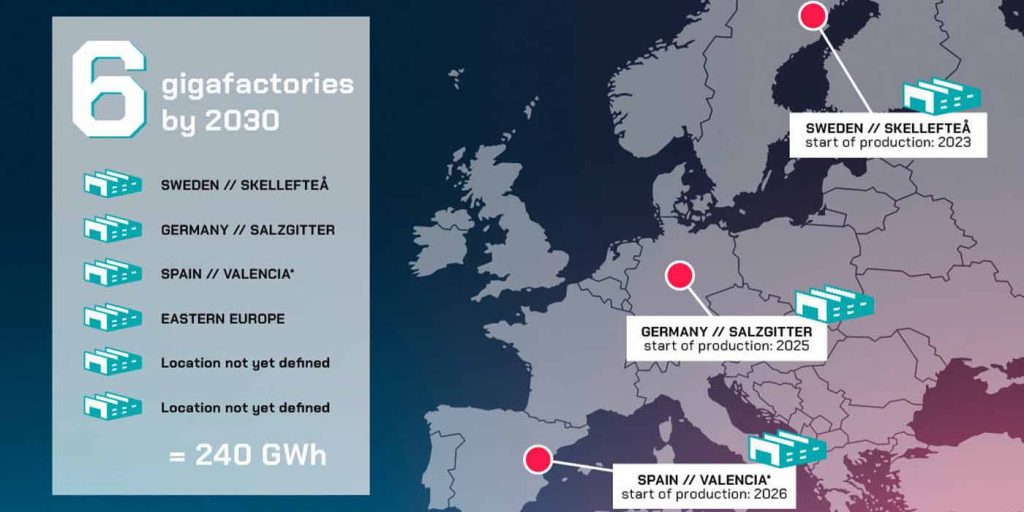

While it was still in the care of ousted CEO Herbert Diess, the Group outlined plans for six new battery gigafactories throughout Europe this decade, including a site in Skellefteå, Sweden through a joint venture with NorthVolt scheduled to open this year.

Last month, we covered news that VW Group sub-brand Seat would be revamping its production facilities in Spain to include a new battery facility for other Group EVs as well. Looking ahead, Volkswagen has been exploring the location of a battery plant for Eastern Europe but said last fall that it would not share a final decision until sometime in the first half of 2023.

With three battery plants under construction and four more planned, Volkswagen Group is reportedly pausing further development as it awaits the EU’s response the the US’ Inflation Reduction Act – enacted legislation the Group believes can offer billions of dollars in incentives.

Volkswagen to prioritize US battery plant for now

Financial Times reports that Volkswagen Group has put a pin in plans for its pending battery plant in Eastern Europe to focus on a separate facility in the US. The reasoning behind this decision is the estimated $10.5 billion the global automaker could receive in incentives by bringing EV battery production to US soil.

Although European automakers like Volkswagen were initially against President Biden’s massive $369 billion subsidy package to bolster local EV and battery production, many have come around now that they’ve learned the benefits at their disposal for shifting production stateside.

Last week, Volkswagen told EU officials it is expecting to claim between $9.5-$10.5 billion in subsidies and loans from the Inflation Reduction Act (IRA) over the lifetime of its pending North American battery plant. As a result, the Group is honing in its development focus on the US facility while it waits to see how the EU will respond with its own subsidies package in what is being referred to as the “EU Green Deal.”

The EU Commission has been toiling away on its own local subsidies for EV and battery production, but industry executives have said it hasn’t been able to compete with the benefits of the IRA so far. In fact, a senior executive present at a Commission meeting held in Brussels last week said, “It looks pretty bad. There was an absence of concrete measures.”

We should learn just how bad (or good) those measures (or lack thereof) are next week when the EU Commission publishes a Net Zero Industry Act in response to the IRA. Meanwhile, Volkswagen says it will be looking for “the right framework conditions” before committing to build any more battery plants in Europe.

No decision on the location of the North American plant has been made by Volkswagen Group yet, or at least not shared publicly. The Group’s newest brand, Scout Motors recently announced it will set up its production footprint in the state of South Carolina, where we may also see Audi EV production someday, although that has not been confirmed.

Either way, Volkswagen has already secured raw materials vital to EV battery production from the Canadian government and should be ready to go in North America when it chooses its future home for the battery plant.

FTC: We use income earning auto affiliate links. More.