Tesla’s infrastructure is growing at a new record pace with more stores and service centers added in the last quarter than ever, but it’s still not growing as fast as its deliveries.

The phrase “victim of its own success” is something that you can often apply to Tesla, especially when it comes to service.

The automaker has been growing its production and deliveries so fast that it has been hard to keep up the infrastructure to support such a fast-growing customer fleet. However, we are now seeing Tesla deploy new infrastructure at a record pace based on the new data released in Tesla’s Q3 2022 financial results.

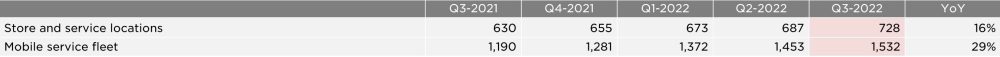

Tesla’s store and service center count increased to a record 728 locations last quarter. Last quarter, Tesla added 41 retail and service locations. That’s significantly more than 18 to 25 new locations it opened every quarter for the past two years:

While this is a new record number of locations opened in a quarter, it is still only growing 16% year-over-year compared to 42% growth for Tesla’s deliveries during the same period. To be fair, locations don’t equal service capacity as Tesla has been investing lately in bigger service centers, and it has been changing its service process to increase capacity.

Tesla has also been growing its mobile service fleet, which consists of vehicle technicians traveling in cars and vans equipped to do the most common service tasks performed on Tesla vehicles. The company added 79 new vehicles to that fleet for 29% year-over-year growth.

Service is not the only infrastructure that Tesla is growing at a record pace. Tesla deployed 2,718 new Superchargers in Q3 2022. That’s more than the 2,508 Superchargers it deployed the previous quarter, which itself was a record. The automaker now operates 38,883 Superchargers at 4,283 locations around the world. It grew 33% year-over-year – again lagging a bit behind Tesla’s 42% global delivery growth.

In the case of the Supercharger network, you can’t even just compare it to Tesla’s delivery growth since the automaker is also opening up the network to non-Tesla EVs, and it is starting to become a significant revenue stream.

Tesla noted in its Q3 shareholder’s letter:

Paid supercharging grew more than 3x compared to the prior year and we are working to further accelerate our deployments. We continue to expand Supercharging pricing from fixed to variable to better manage vehicle flow through our network.

The automaker has been investing in bigger Supercharger stations with more connectors per station, which has also been contributing to total charging capacity deployment.

FTC: We use income earning auto affiliate links. More.

Subscribe to Electrek on YouTube for exclusive videos and subscribe to the podcast.

![Finance a new EV for less: EV deals with 0% interest this September [update]](https://i0.wp.com/electrek.co/wp-content/uploads/sites/3/2024/08/Polestar-first-electric-SUV-US-1.jpeg?resize=1200,628&quality=82&strip=all&ssl=1)

![This is it: the FIRST pure electric vehicle to wear a Lamborghini badge [video]](https://i0.wp.com/electrek.co/wp-content/uploads/sites/3/2025/09/lamborghini_pwc.jpg?resize=1200,628&quality=82&strip=all&ssl=1)

![Stellantis' new EV battery tech will put it ahead of – well, EVERYONE [video]](https://i0.wp.com/electrek.co/wp-content/uploads/sites/3/2025/09/Peugeot-E-3008_MAIN.jpg?resize=1200,628&quality=82&strip=all&ssl=1)