We are, the Bank of England governor said on Monday, facing a historic shock to our incomes.

In fact, he added, “the shock from energy prices this year will be larger than any single year in the 1970s.”

The claim from Andrew Bailey, made at a think tank event in Brussels, is especially striking given the associations we all have with the 1970s – one oil price shock after another, feeding into spiralling costs at the pumps, in our homes and across the economy.

Yet if anything the governor isn’t being dramatic enough, for actually households are potentially facing the biggest energy bill shock since 1950s – if not much earlier.

That is the finding of analysis carried out by Sky News, using the official projections for income growth and spending produced by the Office for Budget Responsibility last week.

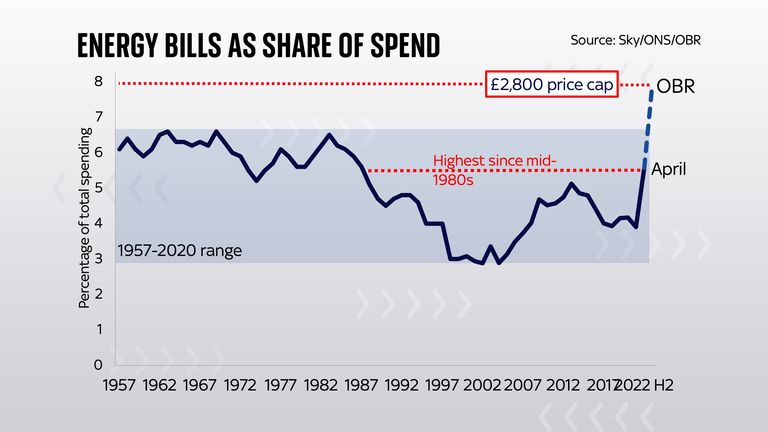

If the energy price cap goes up in line with the OBR’s own projections – to an average of £2,800 – those bills would represent 8% of projected household spending. That would be the highest share spent on energy since at least 1957 – considerably higher than the previous peak of 6.6% in 1963.

Sky calculations also show that if that OBR projection turns out to be right, even after the chancellor’s measures announced earlier this year – including a rebate (which will be clawed back) and a council tax cut for many families – the share spent on energy bills will still be 7% – an all-time high.

Our analysis is based a trove of official data which has been collected since 1957 on family spending.

In order to ensure the numbers are as conservative as possible, we have assumed that family spending rises this year in line with OBR forecasts of nominal GDP this year. Given it is quite plausible that households cut back their spending in the face of high prices, the eventual proportion of spending going on bills may be even higher.

However, it is important to note that much will depend on what happens to the wholesale price of gas and electricity between now and August, when Ofgem is due to announce the level of the price cap that will kick in in October.

The price cap gets updated twice a year. The last update – announced in February – pushed up the average bill to just under £2,000. That price cap – due to kick in this Friday – will lift energy bills to the highest proportion of spending since the mid-1980s. For many families – especially those on low incomes – the strain of this will be especially severe.

However, with gas prices still above where they were last autumn, the cap could rise significantly later on this year taking it into uncharted territory. However, with wholesale gas prices (the prices suppliers pay and hence the basis of the price cap) yo-yoing dramatically in the face of the Russia-Ukraine war, guessing at that eventual level is a tricky exercise.

For instance, at the time the OBR set its forecasts in stone a few weeks ago, the wholesale gas price was pointing towards a £2,800 price cap. But since then, wholesale prices have more than halved, from 511p-a-therm to 252p-a-therm.

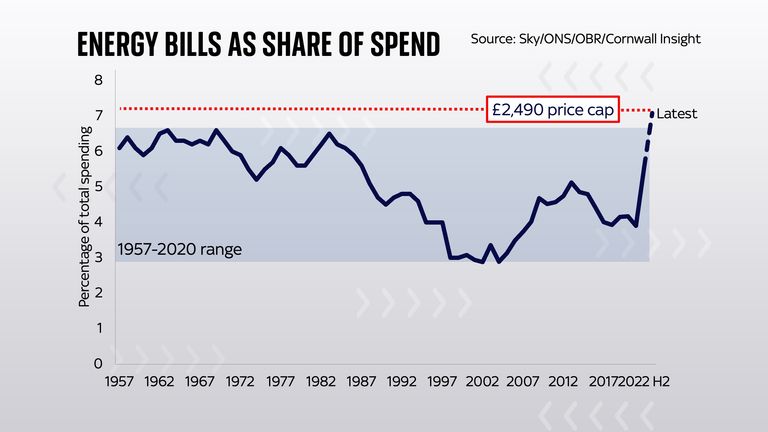

Something similar has happened for the future prices traded on markets. The upshot is that, as things currently stand, the projected level of the price cap in October is £2,490, according to Cornwall Insight, a consultancy which models this number.

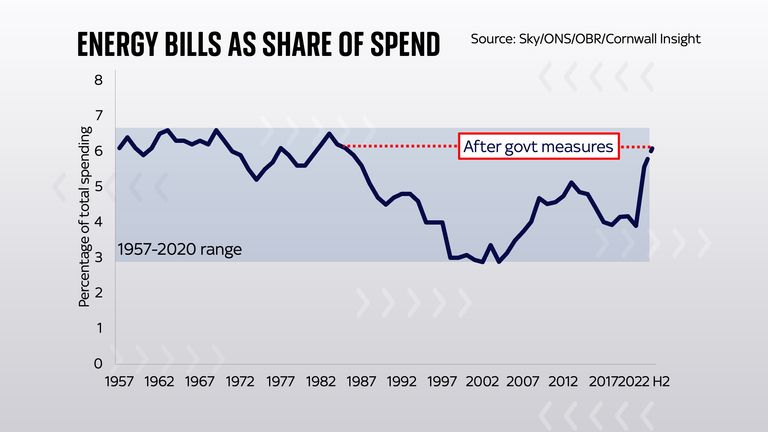

If consumers paid that level, they would on average be paying the biggest chunk of their household spending on record: about 7.1%. However, after the chancellor’s rebates, the energy bill burden would come down to an average of 6.1%.

That is the highest since 1984: no cause for celebration but not quite as dramatic as some of those other numbers.

It’s a reminder that much now depends on what happens to wholesale gas prices in the coming months. And a reminder of why we are very likely to see the chancellor return with more support later on this year.

According to insiders, the Treasury had long pencilled in a potential intervention in August, timed to coincide with Ofgem’s announcement of its next price cap.

So they, like the rest of us, will spend much of the coming months monitoring gas prices, checking flows of the molecules from Russia to the EU and trying to work out whether the energy price squeeze we’re facing is the highest recorded in history – or “merely” the highest in a generation.