Tesla insiders have been unloading their shares at an impressive rate. Excluding CEO Elon Musk, Tesla executives and board members have sold more than 50% of their TSLA shares over the last year.

And that might only be part of the story.

Public companies are required to report insider trading by key executives and board members.

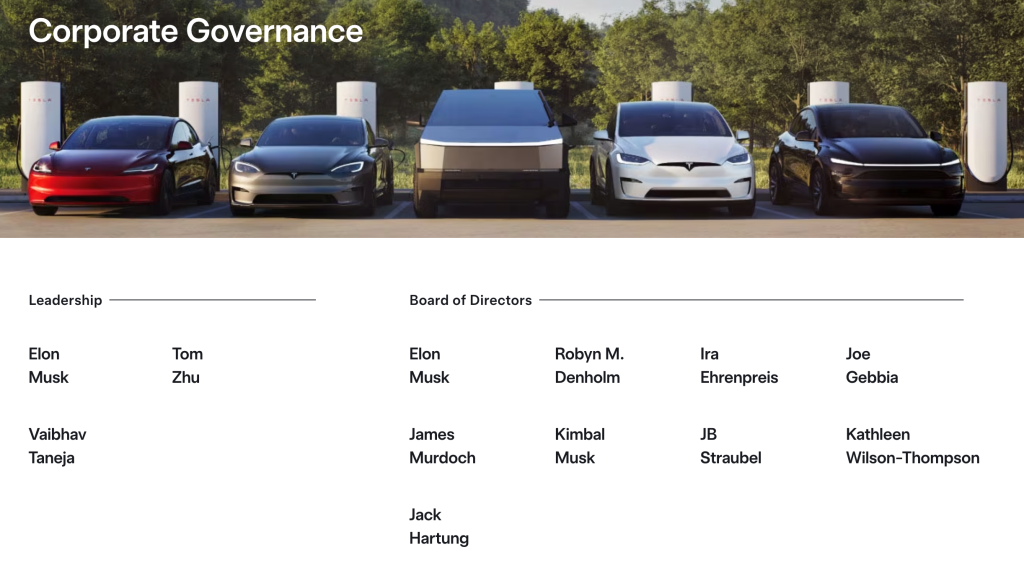

In recent years, Tesla’s number of key executives has dwindled to now only three:

- Elon Musk

- Tom Zhu

- Vaibhav Taneja

Here’s Tesla’s corporate governance page on its investor relations website:

That’s partly due to several of them leaving in the last year, including Drew Baglino, who was the de facto head of engineering and was listed as a key executive before leaving last year.

It’s also because Musk is known to micro-manage, resulting in him having many direct reports who would generally go through other department heads.

The result is that only two Tesla executives, in addition to Musk, who would have to report his transactions even if he weren’t CEO, since he owns more than 10% of the company, are required to report their stock transactions.

Based on Tesla’s 2024 proxy statement, here were the insider ownership last year:

| TSLA Insider Ownership | Total | Shares | Options |

|---|---|---|---|

| Elon Musk | 715,022,706 | 303,960,630 | 411,062,076 |

| Vaibhav Taneja | 1,063,544 | 105,032 | 958,512 |

| Andrew Baglino | 1,218,669 | 31,230 | 1,187,439 |

| Tom Zhu | 1,996,983 | 63,171 | 1,933,812 |

| Robyn Denholm | 1,490,069 | 15,000 | 1,475,069 |

| Ira Ehrenpreis | 1,681,005 | 1,571,005 | 110,000 |

| Joe Gebbia | 111 | 111 | 0 |

| James Murdoch | 1,427,295 | 157,275 | 1,270,020 |

| Kimbal Musk | 1,950,470 | 1,608,720 | 341,750 |

| Kathleen Wilson‑Thompson | 771,255 | 5,400 | 765,855 |

| TOTAL | 726,622,107 | 307,517,574 | 419,104,533 |

| TOTAL Excl. Elon Musk | 11,599,401 | 3,556,944 | 8,042,457 |

Now here’s the ownership of Tesla shares and options from insiders based on the 2025 proxy statement:

| Name | Total | Shares | Options | As‑of (filing) |

|---|---|---|---|---|

| Elon Musk | 714,754,706 | 410,794,076 | 303,960,630 | 12/31/2024 (10‑K/A filed 4/30/2025) |

| Vaibhav Taneja | 830,844 | 116,924 | 713,920 | 7/8/2025 |

| Andrew Baglino | 520,005 | 31,230 | 488,775 | 4/1/2024 (latest) |

| Tom Zhu | 348,250 | 67,600 | 280,650 | 6/12/2025 |

| Robyn Denholm | 85,000 | 85,000 | 0 | 5/6/2025 |

| Ira Ehrenpreis | 855,394 | 855,394 | 0 | 5/27/2025 |

| Joe Gebbia | 4,111 | 4,111 | 0 | 4/24/2025 |

| James Murdoch | 1,282,519 | 884,306 | 398,213 | 3/10/2025 |

| Kimbal Musk | 1,463,220 | 1,463,220 | 0 | 5/27/2025 |

| Kathleen Wilson‑Thompson | 5,400 | 5,400 | 0 | 5/1/2025 (options canceled) |

| TOTAL (sum of listed rows) | 720,149,449 | 414,307,261 | 305,842,188 | |

| TOTAL excl. Elon Musk | 5,394,743 | 3,513,185 | 1,881,558 |

As you can see, excluding Musk, Tesla insiders sold more than half their shares in the company over the last year.

To be fair, some of those changes also include cancellations of stock options for board members, who settled a shareholders’ lawsuit for having overcompensated themselves.

However, it doesn’t account for the reduction in ownership of more than 6 million shares and stock options, worth approximately $2 billion at today’s share price.

There are also some specific examples of non-board members liquidating their stakes.

Tom Zhu, who has led Tesla’s manufacturing efforts and was at times seen as Musk’s number 2 at Tesla, reduced his stake by 82% in a single year.

This happened while Musk claimed that Tesla will become the most valuable company in the world and roughly 10x its current stock price due to autonomous driving and robots, a claim most unbiased analysts have been highly skeptical about.

Electrek’s Take

More than 50% reduction in ownership in a single year is wild.

But as I hinted at the beginning of the article, this is only what we can see. Other Tesla execs, managers, and employees also have shares and stock options, and they could potentially be selling at an even higher rate. We simply don’t know.

The single reporting person to have bought shares is Joe Gebbia, who only bought about $1 million worth, and he is a multi-billionaire. It would be the equivalent of me buying a few hundred dollars’ worth of Electrek shares – not a great show of confidence in my company.

I’m not in the business of predicting Tesla’s share price. I think it trades mainly on gullible Tesla retail shareholders believing Musk’s lies.

But I believe that Tesla will likely face several challenging quarters in the next few years and may even start incurring losses. I think many executives also see this coming and don’t believe that autonomy and humanoid robots will have a positive financial contribution for a few years, as Musk claims.

Meanwhile, Tesla’s EV business is struggling, and there’s little hope of reversing the trend without fresh new models and innovation – the pace of which appears to have greatly slowed at Tesla, unfortunately.

FTC: We use income earning auto affiliate links. More.

![A new Kia EV5 variant spotted in the US for the first time [Images]](https://i0.wp.com/electrek.co/wp-content/uploads/sites/3/2025/08/Kia-new-EV5-US-3.jpeg?resize=1200,628&quality=82&strip=all&ssl=1)