EV maker Rivian (RIVN) released its third-quarter financial earnings Thursday after the market closed. With fewer deliveries in the quarter, Rivian’s revenue missed expectations. However, the EV maker promises things are looking up from here. Here’s a breakdown of Rivian’s Q3 2024 financial earnings

Earnings preview

Yesterday, Electrek posted a preview of what to look out for in Rivian’s third-quarter earnings. One of the biggest things investors will be watching is Rivian’s top line.

After a supply shortage caused Rivian to lower its production goal for 2024, the company now expects to build between 47,000 and 49,000 vehicles this year, down from the previous 57,000 target.

With another 13,157 EVs built last quarter, Rivian’s production total reached 36,749 through September. To hit its target, Rivian will need to build another 10,251 to 12,251 vehicles in Q4.

Despite this, Rivian still expects slight delivery growth over last year, with between 50,500 and 52,000 units delivered in 2024, up from 50,122 in 2023.

According to Estimize, Rivian is expected to report a loss of $0.96 per share in Q3 2024, an improvement from the 1.19 loss per share last year. Rivian is expected to report revenue of around $1 billion, which would be a 25% drop from the $1.34 billion generated in Q3 2023.

Rivian Q3 2024 earnings breakdown

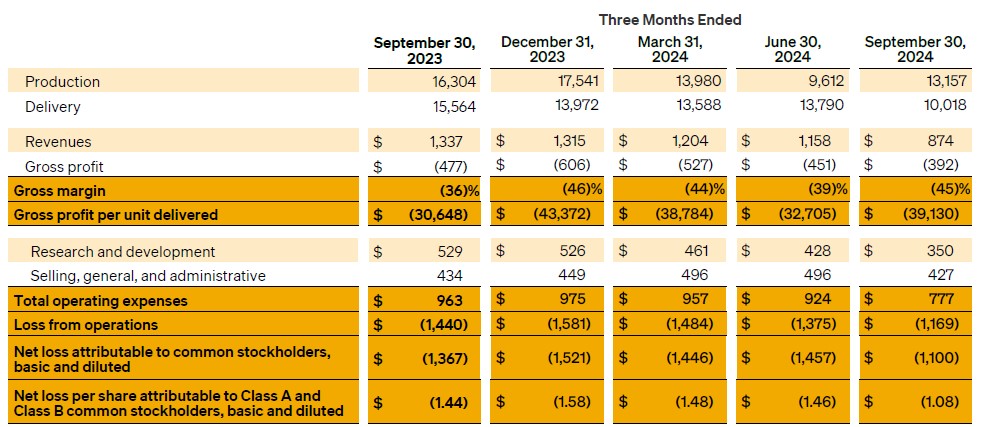

Rivian reported third-quarter revenue of $874 million, a nearly 35% drop from Q3 2023 and missing expectations.

The company said higher electric delivery van (EDV) deliveries for Amazon last year was partly the reason for the lower top-line total.

Rivian posted a gross profit loss of $392 million, down from the $477 million loss last year due to the lower delivery total. Meanwhile, operating losses also fell to $1.17 billion, down from $1.44 billion in Q3 2023.

The company lost $39,130 on every vehicle delivered in Q3 2024, which is up from $30,648 last year and $32,705 in Q2 2024.

| Q3 ’22 | Q4 ’22 | Q1 ’23 | Q2 ’23 | Q3 ’23 | Q4 ’23 | Q1 ’24 | Q2 ’24 | Q3 ’24 | |

| Rivian loss per vehicle | $139,277 | $124,162 | $67,329 | $32,594 | $30,500 | $43,372 | $38,784 | $32,705 | $39,130 |

Rivian’s net loss in the third quarter was $1.1 billion, down from $1.34 billion last year with a $1.08 loss per share.

The EV maker confirmed it’s still on track for a positive gross profit in the fourth quarter of 2024. Rivian’s CEO, RJ Scaringe, said the company is seeing “meaningful progress” on its material costs with new tech and manufacturing processes.

| Q1 2024 | Q2 2024 | Q3 2024 | 2024 YTD | 2024 guidance | |

| Deliveries | 13,588 | 13,790 | 10,018 | 37,396 | 50,500 – 52,000 |

| Production | 13,980 | 9,612 | 13,157 | 36,749 | 47,000 – 49,000 |

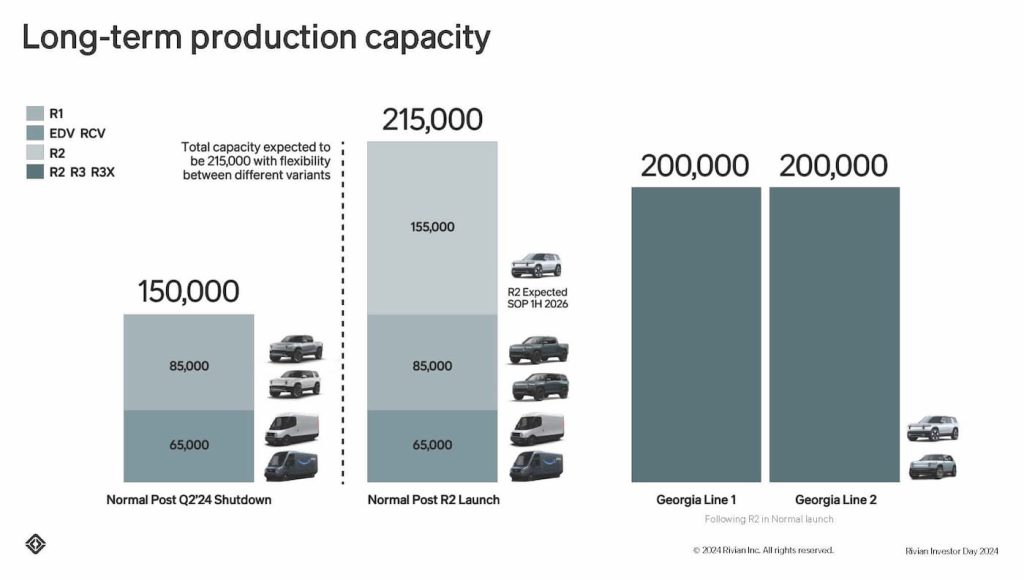

These improvements are meaningful steps toward its next-gen R2, which will launch in the first half of 2026.

Scaringe said Rivian believes R2 will be a “fundamental driver of Rivian’s growth.” It will start at $45,000, nearly half the cost of its current R1S and R1T models.

Once R2 production begins, Rivian expects the new EV will account for most of its output. The company plans to build 155,000 R2 models annually and about 85,000 R1S and R1Ts in Normal.

Rivian also believes its new alliance with Volkswagen will be “a landmark development for the industry.” The total deal size is up to $5 billion, which Rivian said is a “meaningful financial opportunity.”

The planned investments in addition to Rivian’s current cash and equivalents “are expected to provide the capital to fund Rivian’s operations through the ramp of R2 in Normal, as well as the midsize platform in Georgia,” the company said. This will establish a path to positive free cash flow and meaningful scale.

The company ended the quarter with $6.7 billion in cash and equivalents, including a $1 billion convertible note from Volkswagen. Rivian reaffirmed its (revised) production and delivery targets for 2024.

Due to the lower production outlook, Rivian now expects an EBITDA loss of $2.83 billion to $2.88 billion, compared to the previous guidance of a $2.7 billion loss.

Check back for more following Rivian’s earnings call with investors. We will post updates below.

FTC: We use income earning auto affiliate links. More.