Tesla (TSLA) is having its first good quarter (Q3) in a while. Still, it will likely be its last decent quarter for a while, as competition, incentives, and macroeconomic factors are all turning against the American automaker.

Analysts are updating their estimates for Tesla’s electric vehicle deliveries in Q3, which is ending in a week, and it is starting to look like a somewhat decent quarter for the automaker.

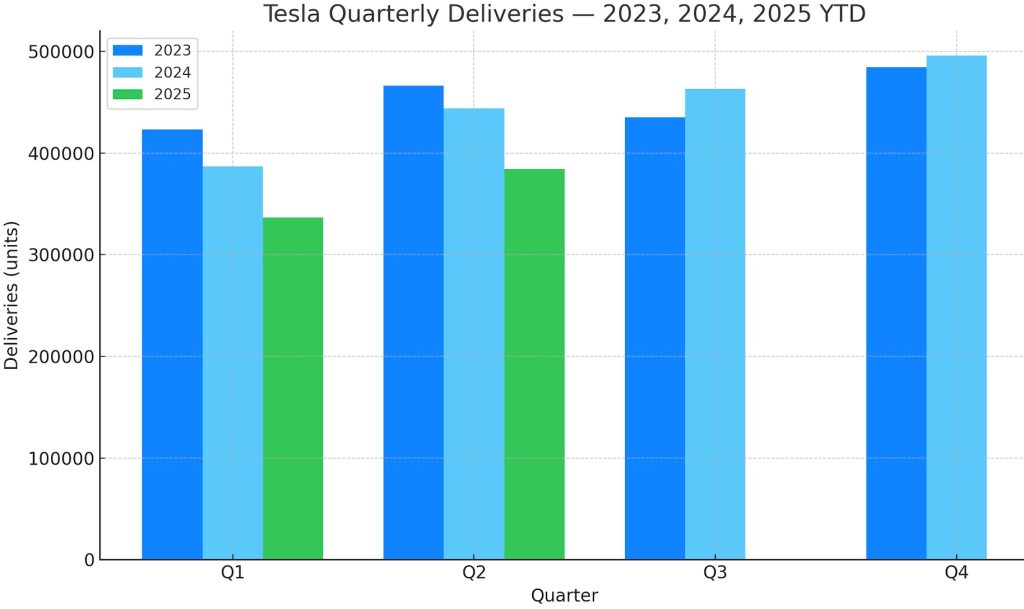

“Somewhat decent” in comparison to Tesla’s recent performance, which has been a steady decline over the last two years.

The range of estimated deliveries is now between 430,000 and 480,000 Tesla deliveries in Q3, with the most consistently accurate analysts being in the higher end of that range.

In Q3 2024, Tesla delivered 463,000 vehicles, indicating that the Company has a real shot at increasing deliveries year-over-year this quarter.

It would break the trend so far this year:

However, this is not a trend that will continue. Tesla’s deliveries in Q3 are inflated due to demand being pulled forward in the US from Q4, resulting from the end of the federal tax credit for electric vehicles.

Tesla’s improved performance in Q3 is primarily driven by the US due to the incentive situation.

In Europe, Tesla is still doing poorly. Based on registration data in the daily reporting European markets, Tesla is down more than 5,000 units compared to the same period last year.

Year-to-date, Tesla is down a massive 37% in Europe.

In China, Tesla is down by more than 24,000 units so far this year, and Q3 is contributing to the decline, based on insurance registration data, with a week left in the quarter.

Electrek’s Take

It appears that Tesla is poised to perform well this quarter, thanks to the end of the tax credit under Trump. It pulled so much demand into Q3 that Tesla was able to liquidate almost its entire Model 3/Y inventory (still plenty of Cybertruck, Model S/X available), which had been accumulating all year.

I can see Tesla delivering 480,000 vehicles in Q3.

But it’s only going to be good for a few good headlines this quarter. After that, the decline continues.

There doesn’t seem to be a stop to the decline in Europe. I see it stabilizing at being down roughly 40% and I doubt next year is going to be better as more Chinese automakers launch in Europe.

Speaking of Chinese automakers, Tesla is getting slowly squeezed in China. The competition is immense there and we are seeing Tesla’s sales steadily decline in the country.

I believe the decline is going to accelerate next year as Tesla’s brand will be diminished by the stripped-down Model Y, which will operate in an already extremely crowded segment.

Tesla badly needs a refreshed vehicle lineup and a brand that is not attached to one of the most disliked people in the world: Elon Musk.

In short, Tesla is expected to be slightly up year-over-year in Q3, but most likely significantly down in Q4 and down overall in 2025, a trend that is likely to continue into 2026, making it 3 years in a row, unless there are significant changes.

And no. Autonomy is not coming to save this sales decline.

FTC: We use income earning auto affiliate links. More.