Elon Musk has trapped Tesla shareholders in a vicious cycle that has nothing to do with he company’s performance or mission anymore. He is linking a vote for his compensation package, worth up to $1 trillion and more control over the company, to the future of Tesla and, in his delusions of grandeur, “the future of the world.”

He literally said that.

How far would you be willing to go to get $1 trillion? Would you be willing to lie?

Tesla, under the control of Elon Musk, is in full-on marketing mode right now, but it’s not to sell its electric vehicles, whose sales have been down for 2 years now. It’s to sell shareholders on voting for a new, unprecedented compensation package for Musk.

The automaker has historically been against running ads. It dabbled in it after Musk bought Twitter, which relies on advertising, but it quickly gave up on the effort.

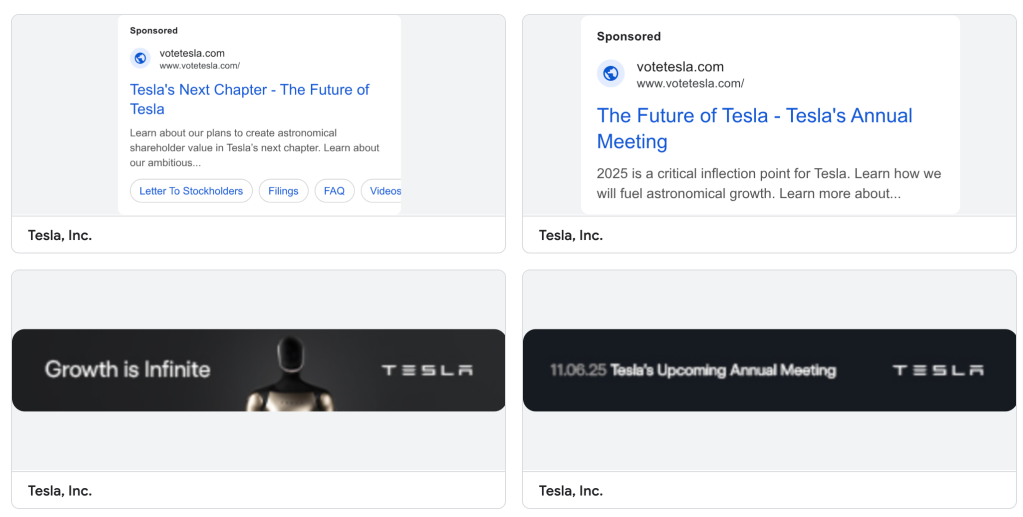

However, Tesla is currently running 5 ads on Google, and they are all about getting Tesla shareholders to vote for Musk’s new compensation package:

You might even see those ads in this article since it is about Tesla, and Google runs most of our ads on Electrek.

Musk himself has been promoting the vote on X (formerly Twitter) and says that “the future of Tesla” and even possibly “the future of the world” hinges on the vote:

“This shareholder vote decides the future of Tesla and may affect the future of the world.”

Tesla also directly urged shareholders to vote as the board recommends at the upcoming shareholders meeting on November 6th:

We are asking you to vote with the Board’s recommendations on *all* proposals. Tesla is on the precipice of another massive wave of transformational growth, as demonstrated by the unveiling of our Master Plan Part IV. If you believe, like us, that Elon Musk is the CEO that can make this ambitious vision a reality, vote your shares.

They have been framing this as a vote on retaining Elon Musk as CEO.

The proposals that shareholders will vote on at the meeting include the reelection of three board members, creating more diluting shares for stock compensation, a vote on Musk’s new compensation package, and a number of proposals brought forward by shareholders.

Tesla’s board is recommending that shareholders vote on all its proposals and vote against all shareholders’ proposals except for one that would authorize Tesla to invest in Musk’s xAI.

Electrek’s Take

“Infinite growth.” The future of Tesla.” “The future of the world.” And it all only happens if you give the world’s richest man the biggest compensation deal ever – in fact, 20x bigger than the next biggest compensation deal ever, which was also his.

That person also happens to have spent the better part of the last year tweeting hundreds of times a day, mostly stoking culture wars and sharing misinformation.

It’s nonsense. This is the kind of bet that degenerate gamblers take, but unfortunately, that’s a big part of the stock market these days. Degenerate gamblers and people lost in Musk’s cult of personality, which consists of Tesla’s shareholder base these days.

According to the board, Musk has threatened to leave if he doesn’t get this compensation package. As I have often stated, I believe Tesla’s business would improve significantly in both the short and long term without Musk.

However, there’s no doubt that the stock would take a massive hit in the short term, and that’s the trap.

Tesla shareholders are disincentivized to see through Musk’s lies, and Musk has been lying his butt off.

Recently, Musk materially misrepresented Tesla’s sales as strong in Q2, despite a 13% year-over-year decline globally. However, most of the CEO’s lies concern Tesla’s future products, specifically autonomous driving and robots.

He was less than forthcoming about all of Tesla’s public Optimus robot demonstrations being remotely controlled by humans. He has consistently lied to shareholders about Tesla’s being on the verge of achieving unsupervised self-driving without ever sharing any data to prove it.

Tesla has yet to achieve unsupervised self-driving today in 2025, despite Musk claiming it would happen by the end of every year for the last 6 years. When does it become lying?

You might claim that missing a deadline is not “lying” per se and it’s just being too optimistic, but I think the only answer to the question “when will Tesla achieve unsupervised self-driving” that is not a lie is “I don’t know.”

I don’t know. Tesla doesn’t know. And Musk clearly doesn’t know.

The best data currently available point to Tesla being at roughly 400 miles between critical disengagements, and it needs to be at a minimum of 10,000 miles for a limited unsupervised self-driving service.

We don’t know how much time it would take Tesla to close that big gap, but it won’t be by the end of this year, as Musk claims.

As for Optimus, Musk claims that it will propel Tesla to a $25 trillion valuation. Yet, demonstrations point to Tesla being years behind competitors, such as Unitree, Figure, and others.

Last year, Musk promoted an engineer to lead the robot program, but he left just months later, and we just learned today that the head of Optimus AI is also leaving.

The program appears to be in shambles.

Shareholders must believe this delusion that Tesla is somehow going to dominate the humanoid robot and autonomous driving space, despite no evidence to suggest this is happening, and fierce competition ahead in both product segments. If not, Tesla’s stock would crumble because its current EV and energy business can’t justify the stock price.

And who keeps this delusion going? Elon Musk.

Musk has Tesla shareholders in a Stockholm Syndrome situation.

Suppose they vote against him, and he leaves. In that case, he will leave with his delusions, and Tesla would have to revert to trading closer to its fundamentals, which means slashing the stock price roughly in half – assuming its EV business returns to healthier levels without Musk’s brand damage.

Therefore, they gamble on the off chance that Musk can make any of the delusions happen or at least keep it going long enough for the stock price to go up.

There’s no more unmistakable evidence of Tesla shareholders having a case of Stockholm Syndrome than Musk threatening them not to build AI products at Tesla if he doesn’t receive his compensation package, which would increase his control in Tesla.

This constitutes a breach of fiduciary duties, as he himself has claimed that AI products are critical to Tesla’s future.

And then, they ask for Tesla to approve investing in Musk’s private AI startup xAI. Interestingly, this is the only shareholder’s proposal that Tesla’s board is not recommending against. In fact, they are not giving any recommendation for that one.

That’s because Musk has to stay as far away as possible in recommending that Tesla invest in xAI.

Shareholders are currently suing Musk for setting up xAI in the first place. The company is directly competing with Tesla for top talent in breach of Musk’s fiduciary duties to Tesla shareholders as an executive officer of the company.

I have explained this situation in my report on Musk’s attempt to control AI earlier this year:

xAI has directly recruited from Tesla, Musk has diverted computing power meant for Tesla to xAI, and he has spent time working on xAI that he could have spent at Tesla.

It’s pretty funny. Some shareholders are suing for Tesla to get Musk’s entire stake in xAI while others are pushing for Tesla to give money to xAI. It’s madness.

FTC: We use income earning auto affiliate links. More.