Tesla (TSLA) will release its Q2 2025 financial results on Wednesday, July 31, after the market closes. As usual, a conference call and Q&A with Tesla’s management are scheduled after the results.

Here, we’ll look at what the street and retail investors expect for the quarterly results.

Tesla Q2 2025 deliveries and energy deployment

CEO Elon Musk and his loyal shareholders often claim that Tesla is now an AI/Robotics company. However, the truth is that the company’s automotive business continues to drive the vast majority of its financial performance.

Tesla’s revenue remains tied mainly to the number of vehicles it delivers.

Earlier this month, Tesla disclosed its Q2 2025 vehicle production and deliveries:

| Production | Deliveries | Subject to operating lease accounting | |

| Model 3/Y | 396,835 | 373,728 | 2% |

| Other Models | 13,409 | 10,394 | 7% |

| Total | 410,244 | 384,122 | 2% |

The deliveries came in right on expectation, which is about 13.5% down from the same period last year.

Tesla also produced 25,000 vehicles more than it delivered, but that won’t affect its financials this quarter as the automaker only accounts for delivered vehicles in its cost of revenues.

The company also disclosed having deployed 9.6 GWh of energy storage during the quarter – roughly the same as the same period last year.

Tesla Q2 2025 revenue

For revenue, analysts generally have a pretty good idea of what to expect, thanks to the delivery numbers and now the energy storage deployment data.

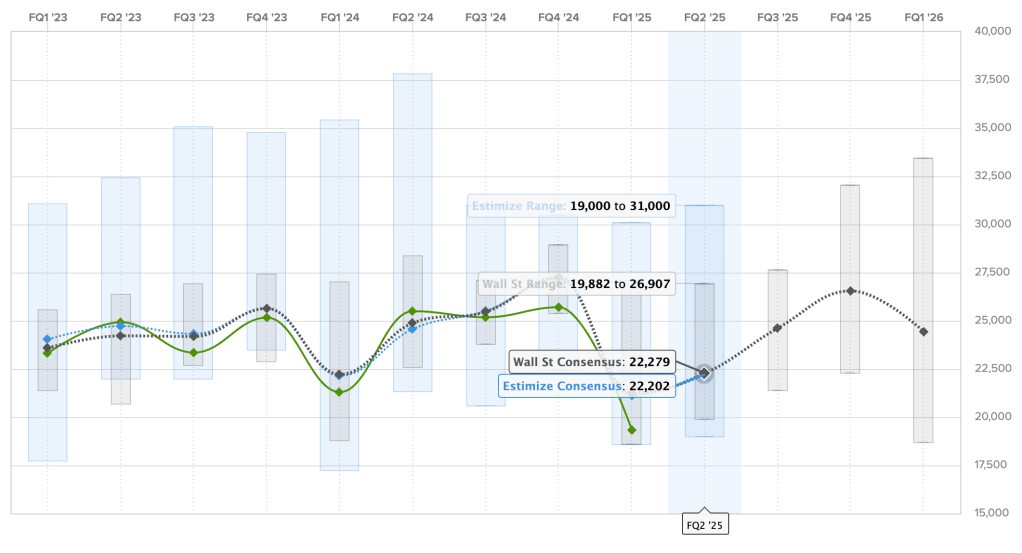

The Wall Street consensus for this quarter is $22.279 billion, and Estimize, the financial estimate crowdsourcing website, predicts a slightly lower revenue of $22.202 billion.

Here are the predictions for Tesla’s revenue over the past two years, with Estimize predictions in blue, Wall Street consensus in gray, and actual results are in green:

This result would be significantly lower than the $25 billion in revenue that Tesla delivered during the same period in 2024.

It’s worth nothing that over the last 3 quarters, Tesla’s revenue came under expectations.

Tesla Q2 2025 earnings

Tesla claims to consistently strive for marginal profitability every quarter, as it invests the majority of its funds in growth, but its growth has disappeared from its automotive business over the last year, and its gross margin is going in the same direction.

Analysts are trying to estimate Tesla’s gross margin with the lower deliveries and higher discounts to figure out its actual earnings per share.

For Q2 2025, the Wall Street consensus is a gain of $0.40 per share and Estimize’s crowdsourced prediction is a little lower at $0.39.

Here are the earnings per share over the last two years, where Estimize predictions are in blue, Wall Street consensus is in gray, and actual results are in green:

If Tesla delivers on expectations, it would be a significant drop in earnings from $0.52 per share in Q2 2024.

Other expectations for the TSLA shareholder’s letter, analyst call, and special ‘company update’

In Q1, Tesla blamed its poor performance on the Model Y changeover. It doesn’t have this excuse in the second quarter.

CEO Elon Musk has been extremely misleading to shareholders about Tesla’s demand situation. He was caught straight up lying about it last quarter.

But I expect Musk to have Tesla shareholders focus on future revenue prospects from robotaxi and robots, something he has been prosming for years without any real evidence that Tesla will lead any of those sectors.

Tesla will also take questions from retail shareholders based on the most popular ones on Say. Here are the top 5 questions and my thoughts on them:

- Can you give us some insight how robotaxis have been performing so far and what rate you expect to expand in terms of vehicles, geofence, cities, and supervisors?

- Tesla has never released publicly any data about its self-driving efforts and it went out of its way to avoid reporting it to authorities and the public. I expect nothing here other than “we are growing as fast as regulators allow it”, which is a lie. Tesla still uses safety supervisors and mapping, which are the limiting factors.

- Can you provide an update on the development and production timeline for Tesla’s more affordable models? How will these models balance cost reduction with profitability, and what impact do you expect on demand in the current economic climate?

- Tesla said that those cheaper models would come in the first half of 2025, but they didn’t. As we have previously mentioned, they are basically stripped down versions of the Model 3 and Model Y, allowing Tesla to reduce the base price. We expect them to launch after the federal tax credit to end at the end of Q3.

- What are the key technical and regulatory hurdles still remaining for unsupervised FSD to be available for personal use? Timeline?

- Tesla hasn’t solved self-driving and it is not coming to consumer vehicles any time soon.

- What specific factory tasks is Optimus currently performing, and what is the expected timeline for scaling production to enable external sales? How does Tesla envision Optimus contributing to revenue in the next 2–3 years?

- When do you anticipate customer vehicles to receive unsupervised FSD?

- He is going to say “next year” like he has been saying every year for the last 6 years and again, it won’t happen.

Anything to distract from the fact that Tesla might start to become unprofitable as soon as Q1 2026.

Tesla’s earnings have been going down over the last 2 years and the trend is clear. Furthermore, the removal of the federal tax credit for EVs in the US, Tesla’s healthiest large market, and most ZEV credits going away are accelerating the trend in Q4 2025 and Q1 2026.

Tune in with Electrek after market close today to get all the latest news from Tesla’s earnings, conference call, and now also an apparent “company update.”

FTC: We use income earning auto affiliate links. More.