Sir Keir Starmer’s controversial welfare bill has passed its first hurdle in the Commons despite a sizeable rebellion from his MPs.

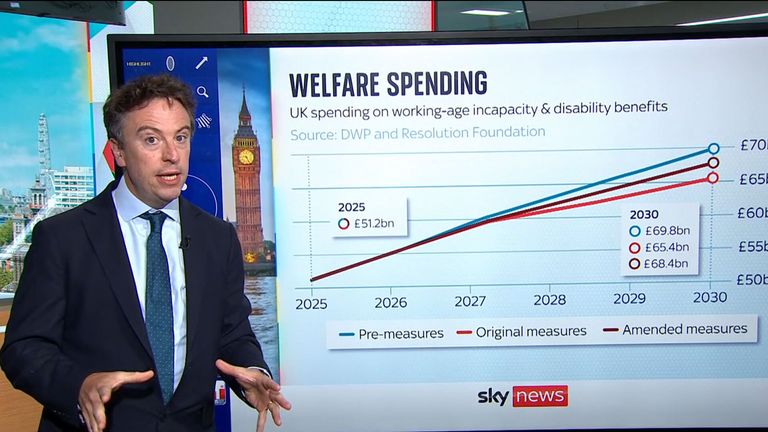

The prime minister’s watered-down Universal Credit and Personal Independent Payment Bill, aimed at saving £5.5bn, was backed by a majority of 75 on Tuesday evening.

A total of 49 Labour MPs voted against the bill – the largest rebellion since 47 MPs voted against Tony Blair’s Lone Parent benefit in 1997, according to Professor Phil Cowley from Queen Mary University.

Politics latest: Chancellor left in ‘impossible situation’ after PM survives welfare rebellion

After multiple concessions made due to threats of a Labour rebellion, many MPs questioned what they were voting for as the bill had been severely stripped down.

They ended up voting for only one part of the plan: a cut to Universal Credit (UC) sickness benefits for new claimants from £97 a week to £50 from 2026/7.

The Institute for Fiscal Studies (IFS) said the bill voted through “is not expected to deliver any savings over the next four years” because the savings from reducing the Universal Credit health element for new claimants will be roughly offset by the cost of increasing the UC standard allowance.

Just 90 minutes before voting started on Tuesday evening, disabilities minister Stephen Timms announced the last of a series of concessions made as dozens of Labour MPs spoke of their fears for disabled and sick people if the bill was made law.

How did your MP vote on Labour’s welfare bill?

In a major U-turn, he said changes in eligibility for the personal independence payment (PIP), the main disability payment to help pay for extra costs incurred, would not take place until a review he is carrying out into the benefit is published in autumn 2026.

An amendment brought by Labour MP Rachael Maskell, which aimed to prevent the bill progressing to the next stage, was defeated but 44 Labour MPs voted for it.

A Number 10 source told Sky News’ political editor Beth Rigby: “Change isn’t easy, we’ve always known that, we’re determined to deliver on the mandate the country gave us, to make Britain work for hardworking people.

“We accept the will of the house, and want to take colleagues with us, our destination – a social security system that supports the most vulnerable, and enables people to thrive – remains.”

But the Conservative shadow chancellor Mel Stride called the vote “farcical” and said the government “ended up in this terrible situation” because they “rushed it”.

He warned the markets “will have noticed that when it comes to taking tougher decisions about controlling and spending, this government has been found wanting”.

Work and Pensions Secretary Liz Kendall said: “I wish we’d got to this point in a different way. And there are absolutely lessons to learn.

“But I think it’s really important we pass this bill at the second reading, it put some really important reforms to the welfare system – tackling work disincentives, making sure that people with severe conditions would no longer be assessed and alongside our investment in employment support this will help people get back to work, because that’s the brighter future for them.”

She made further concessions on Monday in the hope the rebels’ fears would be allayed, but many were concerned the PIP eligibility was going to be changed at the same time the review was published, meaning its findings would not be taken into account.

Her changes were:

• Current PIP claimants, and any up to November 2026, would have the same eligibility criteria as they do now, instead of the stricter measure proposed

• A consultation into PIP to be “co-produced” with disabled people and published in autumn 2026

• For existing and future Universal Credit (UC) claimants, the combined value of the standard UC allowance and the health top-up will rise “at least in line with inflation” every year for the rest of this parliament

• The UC health top-up, for people with limited ability to work due to a disability or long-term sickness, will get a £300m boost next year – doubling the current amount – then rising to £800m the year after and £1bn in 2028/29.