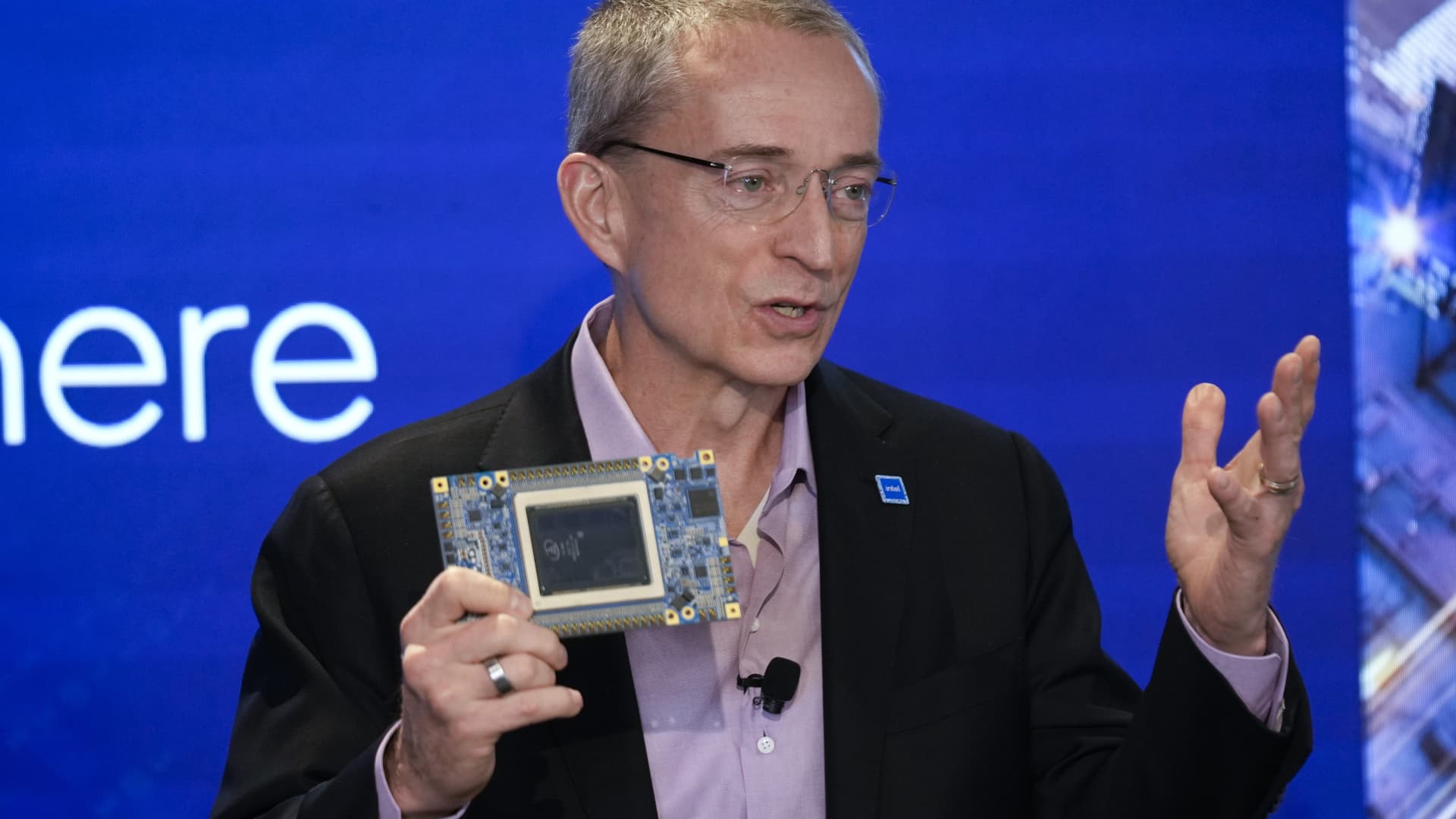

Intel CEO Pat Gelsinger speaks while holding a new chip, called Gaudi 3, during an event called AI Everywhere in New York, Thursday, Dec. 14, 2023.

Seth Wenig | AP

Intel shares fell more than 5% on Tuesday, a day after the embattled chipmaker announced the ouster of CEO Pat Gelsinger, whose four-year tenure was marred by market share losses and a major miss in artificial intelligence.

The stock was headed for its worst day since early September as of early afternoon trading and has lost more than half its value this year.

Intel said Monday that CFO David Zinsner and Intel products CEO MJ Holthaus would serve as interim co-CEOs while the board and a search committee “work diligently and expeditiously to find a permanent successor to Gelsinger.” Longtime board member Frank Yeary will serve as interim executive chair.

Cantor analysts are skeptical that any one leader can revive the company, writing in a note to clients on Tuesday that Gelsinger isn’t responsible for Intel’s challenges and, “we simply do not see a quick fix here.” The firm has the equivalent of a hold rating on the stock.

Intel’s revenue dropped 6% in the most recent period and has declined on a year-over-year basis in nine of the past 11 quarters. Meanwhile, rival chipmaker Nvidia has vaulted past $3 trillion in market cap and is at the heart of the artificial intelligence boom, as fellow tech giants like Amazon, Meta and Alphabet snap up the company’s graphics processing units at an increasingly rapid clip.

Gelsinger, who succeeded Bob Swan as CEO in 2021, has been at the helm during Nvidia’s rise, which has coincided with a loss of market share in Intel’s core PC and data center business to Advanced Micro Devices. At the same time, Intel has refocused much of the company into becoming a foundry, manufacturing processors for other chipmakers. It’s a costly proposition that the company said in September would lead to the foundry becoming an independent subsidiary, enabling it to raise outside funding.

“A lot of the problems recently have been caused by the insistence on the foundry business,” Chris Danely, an analyst at Citi Research, told CNBC’s “Money Movers” on Monday. “They’re still losing billions every quarter.”

Danely added that “the clock started ticking on Pat” when the foundry business showed significant margin shrinkage over the summer.

Following Intel’s second-quarter earnings report in August, the stock sank 26%, its steepest decline in 50 years and second-worst day ever. Gelsinger announced at the time that the company was cutting 15% of its workforce as part of a $10 billion cost-reduction plan.

Cantor analysts say more cuts are likely waiting for Gelsinger’s eventual successor.

“We suspect a much more aggressive cost-cutting strategy as well as expedited sale of non-core assets may occur,” they wrote. “But at the end of the day, this doesn’t solve the foundry problem — which is simply there are no high volume external customers.”

— CNBC’s Rohan Goswami and Kif Leswing contributed to this report.