Mark Zuckerberg, CEO of Meta, testifies during the Senate Judiciary Committee hearing titled “Big Tech and the Online Child Sexual Exploitation Crisis,” in Dirksen building on Wednesday, January 31, 2024.

Tom Williams | CQ-Roll Call, Inc. | Getty Images

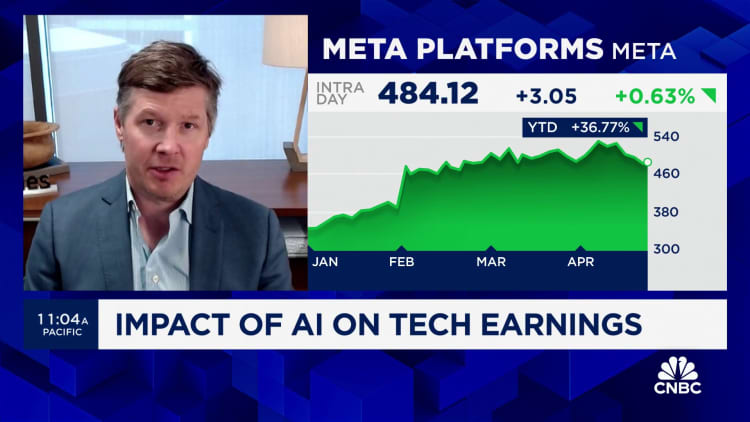

Meta shares plunged in extended trading on Wednesday after the company issued a light forecast, overshadowing better-than-expected first-quarter results.

Here are the key numbers:

- Earnings per share: $4.71 per share vs. $4.32 per share expected by LSEG

- Revenue: $36.46 billion vs. $36.16 billion expected by LSEG

Revenue increased 27% from $28.65 billion in the same period a year earlier, the fastest rate of expansion for any quarter since 2021.

Meta said it expects revenue in the second quarter of $36.5 billion to $39 billion. The midpoint of the range, $37.75 billion, would represent 18% year-over-year growth and is below analysts’ average estimate of $38.3 billion.

The company no longer reports daily active users and monthly active users. It now gives a figure for what it calls “family daily active people.” That number was 3.24 billion for march, a 7% increase from a year earlier.

Meta has raised investor expectations due to its improved financial performance in recent quarters, leaving little room for error. The stock is up about 40% this year after almost tripling last year. In February 2023, CEO Mark Zuckerberg told investors it would be the “year of efficiency,” which initiated the rally.

Headcount declined by 10% from a year earlier to 69,329.

Capital expenditures for 2024 will be $35 billion to $40 billion, an increase from a prior forecast of $30 billion to $37 billion “as we continue to accelerate our infrastructure investments to support our artificial intelligence (AI) roadmap,” Meta said.

Meta’s Reality Labs unit, which houses the company’s hardware and software for development of the nascent metaverse, continues to bleed cash. Reality Labs reported sales of $440 million for the quarter and $3.85 billion in losses.

Analysts expected the division to show an operating loss of $4.31 billion for the quarter, on top of the $42 billion it’s lost since the end of 2020.

Executives will discuss the company’s results on a call with analysts at 5 p.m. ET.