British people aren’t the only ones to moan about the state and price of housing in their country, but we do have the best justification to do so.

Finland is the only country in the OECD that spends more on housing than British workers as a proportion of total spending.

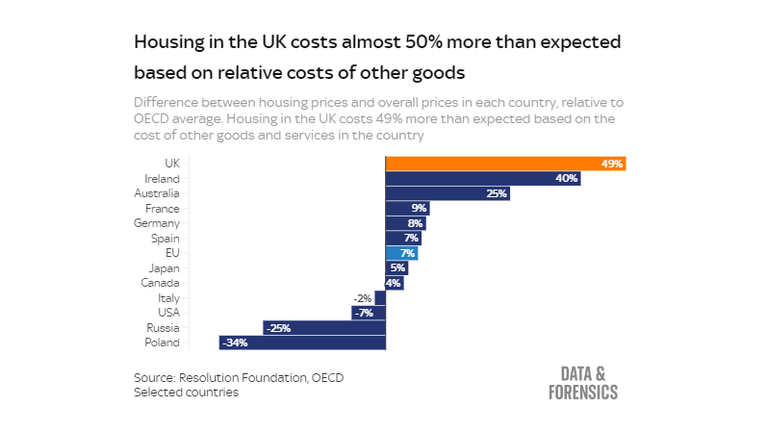

And after you adjust for quality, in terms of size, age and proximity to jobs, the UK has higher housing costs than any other developed economy, research by living-standards thinktank the Resolution Foundation shows.

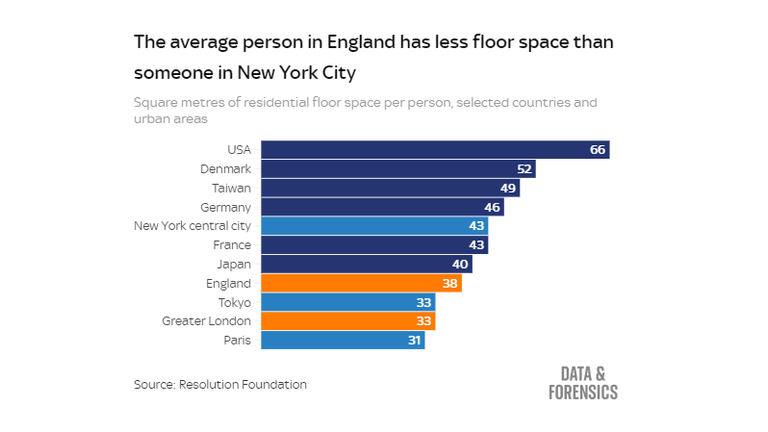

Friends’ watchers have often observed that Monica Geller’s apartment is unrealistically large for someone in her career stage living in the middle of New York, but the data suggests that critique may be being skewed by our lower British standards.

Even people living in the central area of New York City enjoy more floor space than the average English person, and almost a quarter more than Londoners.

On average England has more modest home sizes than the likes of Germany, Denmark, France, Taiwan and Japan (Japan had historically been used to smaller homes but overtook England recently).

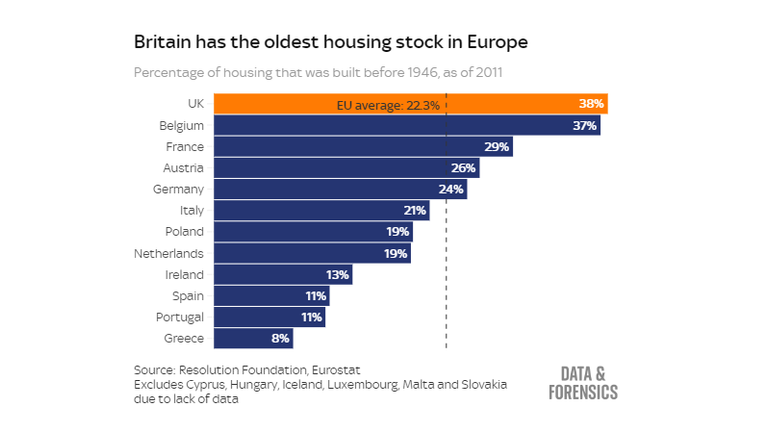

No country in the EU has older housing stock than Britain, with almost four in 10 current UK homes being built before the end of the Second World War.

That’s double the percentage in the Netherlands and almost four times as many as in Finland, the only country spending more on housing overall than the UK.

Partly as a direct result of that, UK houses also perform poorly when it comes to energy efficiency and, says the Resolution Foundation, most likely damp too.

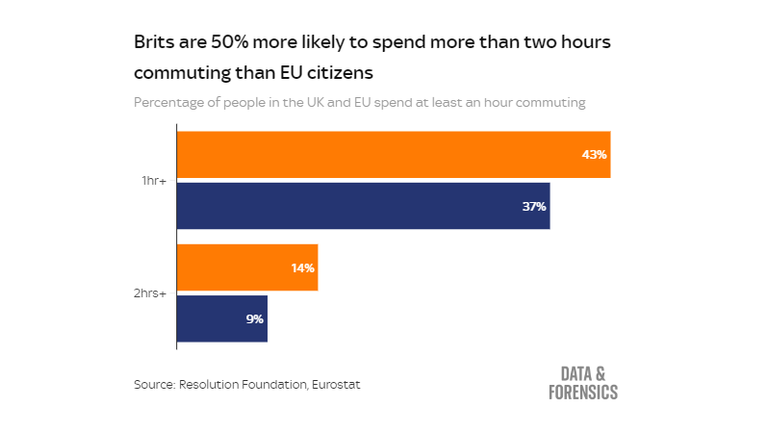

Brits spend longer commuting than the EU average as well, so our expensive, small, old, poor-quality housing isn’t even located in convenient places.

Perhaps unsurprsingly then, we aren’t in a habit of buying more housing than we need. In Europe only Ireland and Germany have lower rates of second-home ownership than England.

Austria and Canada, countries with similar spending levels overall to the UK, buy almost a quarter more housing than British people do.

Where do the parties stand on housing policy?

The government introduced the Renters (Reform) Bill in 2019, which set out plans to strengthen renters’ rights, ban “no-fault” evictions and set a Decent Homes Standard for the private sector (it already exists to set minimum standards for social housing).

But, almost five years on, it has failed to make its way through parliament and it’s unclear when it’s set to return.

Labour has proposed a “renters’ charter” which would also ban “no-fault” evictions, and includes things like rights for renters to have pets or make reasonable alterations to a property. It would also introduce a four-month notice period for landlords and end automatic eviction for rent arrears.

Sir Keir Starmer has also said he would reinstate targets to build 300,000 homes a year under a Labour government.

That was a 2019 Conservative manifesto pledge, but it has never been met and since been downgraded to “advisory” rather than a target by Housing Secretary Michael Gove. There are also different “advisories” for more social housing, again downgraded from targets which weren’t being met.

Rishi Sunak said Tory members, activists and councillors expressed “no support” for “nationally imposed, top-down set of targets… telling them what to do”.

But Lee Rowley, Mr Gove’s current housing minister (and the 16th different Conservative housing minister since 2010), publicly disagreed with his party’s stance in February.

He told Sky News presenter Kay Burley: “We’ve got to have targets. If you haven’t got targets, there’s no way [to make progress].”

Read more:

Both parties have said they plan to help first-time buyers – the Conservatives’ by extending Help to Buy, the policy which lends first-time buyers money to buy affordable new-builds with just a 5% deposit.

Critics say the policy can inflate property prices further however, effectively offsetting the subsidy. The scheme ended in England in October 2022 although it’s still running in Wales.

Labour says it would give first-time buyers “first dibs” on new-builds over existing homeowners. The mechanism for how it would do that in reality has not been fully explained.

Both parties have plans to abolish the leasehold system (although not for flats), restrict short-term and holiday lets, and improve energy efficiency of homes.

Click to subscribe to the Sky News Daily wherever you get your podcasts

Adam Corlett, principal economist at the Resolution Foundation, said: “Britain’s housing crisis is likely to be a big topic in the election campaign, as parties debate how to address the problems of high costs, poor quality and low security that face so many households.

“Britain is one of many countries apparently in the midst of a housing crisis, and it can be difficult to separate rhetoric from reality. But by looking at housing costs, floorspace and wider issues of quality, we find that the UK’s expensive, cramped and ageing housing stock offers the worst value for money of any advanced economy.

“Britain’s housing crisis is decades in the making, with successive governments failing to build enough new homes and modernise our existing stock. That now has to change.”

Methodology

The Resolution Foundation’s research takes into account both “actual” rents, and “imputed” rents – an estimate of the cost of housing owners would pay if they were renting their home on the open market.

This makes it easier to carry out international comparisons because different countries will have different balances of types of tenure – private rent, social rent, owning with a mortgage or outright ownership.

In Italy, for example, 61% of homes are owned outright, compared with 36% in the UK and just 9% in the Netherlands.

This measure examines what people would pay if all households in each country were exposed to the housing market in the same way.

The Data and Forensics team is a multi-skilled unit dedicated to providing transparent journalism from Sky News. We gather, analyse and visualise data to tell data-driven stories. We combine traditional reporting skills with advanced analysis of satellite images, social media and other open-source information. Through multimedia storytelling, we aim to better explain the world while also showing how our journalism is done.