The energy regulator has threatened action against household suppliers if they put investors before hard-pressed households.

Ofgem’s chief executive Jonathan Brearley warned that financial practices seen before the energy crisis would not be tolerated.

New rules were brought in last November to bolster the resilience of business models after the collapse of more than 20 suppliers when Russia’s invasion of Ukraine prompted a spike in wholesale energy costs.

Mr Brearley used an open letter to energy firms to remind them of their obligations including a requirement to hold on to more cash or assets to reduce the risk of them going bust, reducing the cost and disruption of failure in the process.

It was written as the cost of gas and electricity returned to the energy price cap shield from the beginning of the month following the end of the government’s energy price guarantee.

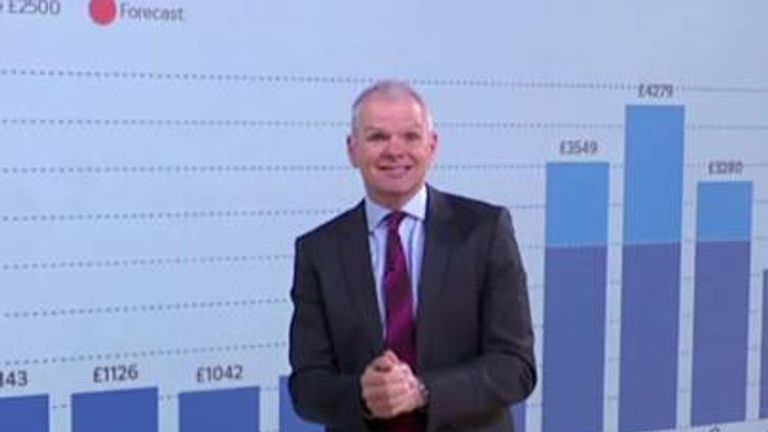

The cap – at just below £2,100 for a typical household – reflects a reduction in the cost of wholesale energy since the peaks of 2022 and early 2023.

Ofgem expects the household supply sector to return to profit this year after five years of losses.

Mr Brearley wrote: “An energy sector where companies can make a reasonable profit is important to create a sustainable and competitive market for consumers.

“However, a return to the practices we saw before the energy crisis isn’t on the table – suppliers must reciprocate the support the sector was given by consumers and taxpayers when wholesale prices increased by behaving responsibly as prices fall and profits return.

“The energy market has changed. Ofgem has introduced major changes to the market, and we need suppliers to learn the lessons of the energy crisis and play their part by making sure they’re financially robust, can absorb potential losses and are meeting our new capital requirements.

“I expect no return to paying out dividends before a supplier has met those essential capital requirements.”

Mr Brearley added that the regulator was closely monitoring suppliers to make sure that prices remained competitive and vulnerable customers were being protected.

Ofgem’s rules were criticised by some in the sector for not going far enough.

Centrica, the owner of British Gas, had argued for instance that Ofgem should have ensured all customer credit balances are ringfenced so consumers and firms are shielded from additional costs in the event of a supplier failure.

The coming winter is set to remain tough for bill-payers as the price cap, that limits the amount suppliers can charge for each unit of gas and electricity, is predicted to remain around the £2k level.

Energy industry consultancy Cornwall Insight said last week it believed that, based on current market pricing and Ofgem’s criteria, the price cap will fall to £1,978.33 from October from July’s £2,074.

It predicted the cap would rise again from January, to £2,004.40, reflecting the time of typical peak demand.