Debt-laden Thames Water has said it is working with shareholders to secure extra cash, as ministers draw up contingency plans in the event of its collapse.

The company, which serves 15 million households, said on Wednesday that it needs “further equity funding” on top of the £500 million it raised just three months ago.

But it insisted it maintains a “strong liquidity position” after ministers met with Ofwat, the industry regulator, to discuss the possibility of placing the firm into temporary public ownership.

The business said in a statement: “Thames Water received the expected £500 million of new funding from its shareholders in March 2023 and is continuing to work constructively with its shareholders in relation to the further equity funding expected to be required to support Thames Water’s turnaround and investment plans.

“Ofwat is being kept fully informed on progress of the company’s turnaround and engagement with shareholders.”

Cost of Living latest: Dismay as supermarket locks baby formula in security cases

Earlier, Sky News revealed the government is discussing placing Thames Water into a special administration regime (SAR) that would effectively take the company into temporary public ownership if it collapses.

Such an insolvency process was used when the energy supplier Bulb collapsed in 2021, sparking concerns that it could cost taxpayers billions of pounds.

Rebecca Pow, the water minister, did not say how much a government bailout could cost when pressed on the matter by Labour in the Commons today.

She insisted the water sector as a whole is “financially resilient” and the government is confident that Ofwat is “working closely with any company that would be facing financial stress”.

However Kemi Badenoch, the business secretary, went further and admitted she is “very concerned” by the situation.

“Obviously this is a commercially sensitive situation and I know that my colleagues across government are looking at what we can do,” she added.

“We need to make sure that Thames Water as an entity survives.”

Thames Water is the UK’s biggest water supplier and provides water services for 15 million customers in London and the South East.

It has come under intense pressure in recent years because of its poor record on leaks, sewage contamination, executive pay and shareholder dividends.

The firm is reportedly racing to raise £1 billion from investors to shore up its finances, with AlixPartners said to be advising the firm on turnaround plans.

A government spokesman said finding the cash “is a matter for the company and its shareholders”.

But they added: “We prepare for a range of scenarios across our regulated industries – including water – as any responsible government would.”

Click to subscribe to the Sky News Daily wherever you get your podcasts

Labour ‘not looking to untangle ownership of water industry’

Taking Thames Water into temporary public ownership would inevitably fuel calls from critics of the privatised water industry to renationalise all of the country’s major water companies.

Ed Miliband, the shadow climate secretary, called the situation an “absolute scandal” and blamed it on 13 years of the Tories “mismanaging” the regulation of the water industry.

Asked if Labour would nationalise water if it wins the next election, he said the government is going to leave behind “an appalling mess which we are going to have to sort out” and Labour will have to “look at the situation we find ourselves in”.

Pressed on what Labour’s approach to the problems would be, a party spokesman later said: “Spending hundreds of billions of pounds and taking years to untangle the ownership of the water industry is not what we’re looking to do.

“But regardless of ownership status, the water industry requires a plan that delivers change and drives standards. It shouldn’t be left to the public to clean up the mess or pay the price of Tory failure.”

Thames Water is owned by a consortium of pension funds and sovereign wealth funds, many of which are understood to be sceptical about delivering additional funding.

On Tuesday its chief executive, Sarah Bentley resigned with immediate effect after criticism of her £1.6m pay packet and the company’s environmental performance.

Thames Water has been fined numerous times, and is facing a deluge of regulatory probes.

In 2021, it was hit with a £4m penalty for allowing untreated sewage to escape into a river and park, while in August 2021, it was ordered to pay £11m for overcharging thousands of customers.

Ofwat warned last December over the financial resilience of Thames Water, as well as Yorkshire Water, SES Water and Portsmouth Water.

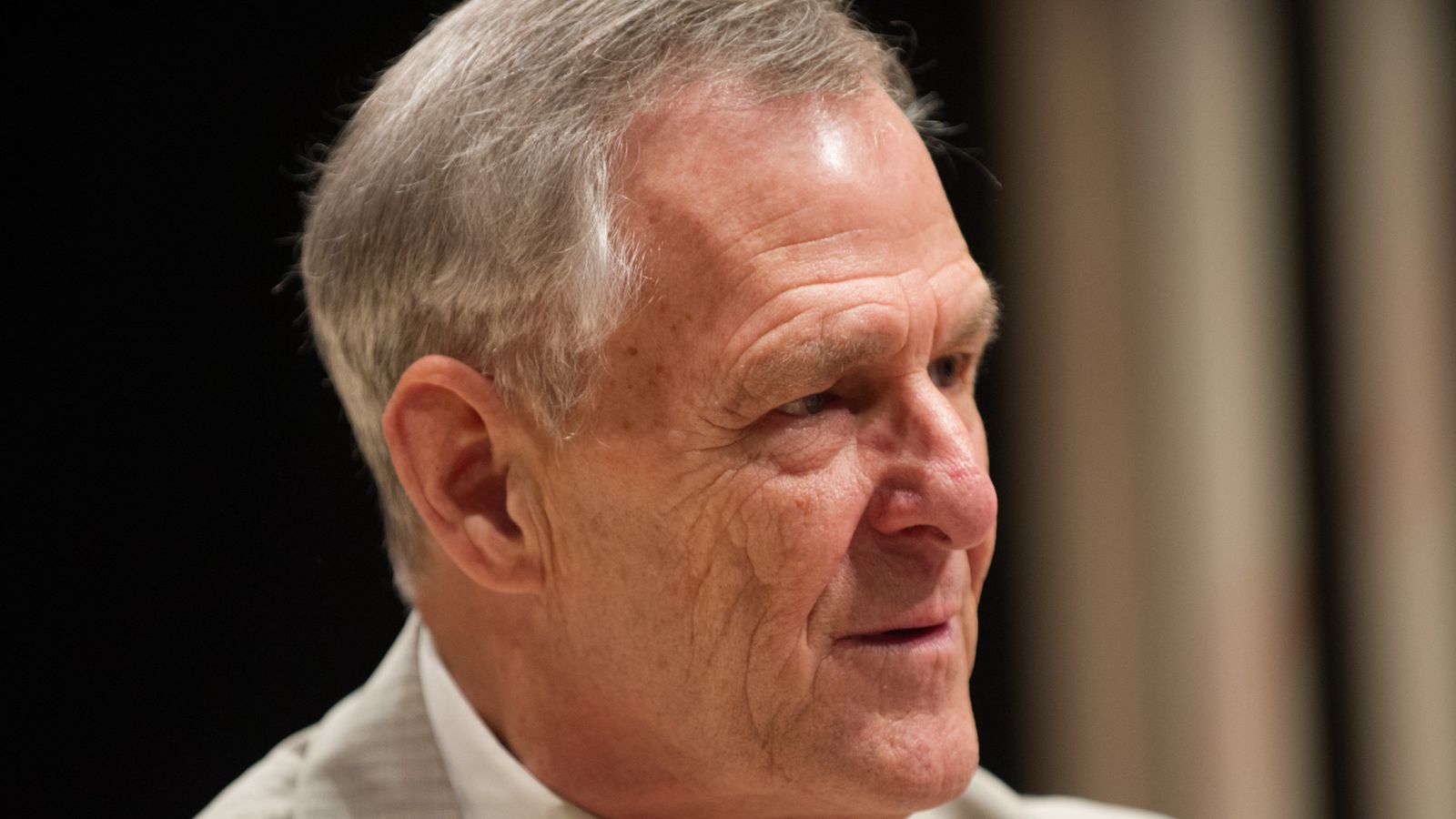

Work and Pensions Secretary Mel Stride said he is confident that “whatever the situation is at Thames Water, the water will continue to flow”.