The U.S. has placed major chip export restrictions on Huawei and Chinese firms over the past few years. This has cut off companies’ access to critical semiconductors.

Jaap Arriens | Nurphoto | Getty Images

China’s chip industry will be “reborn” as a result of U.S. sanctions, a top boss at Huawei said Friday, as the Chinese telecommunications giant confirmed a breakthrough in semiconductor design technology.

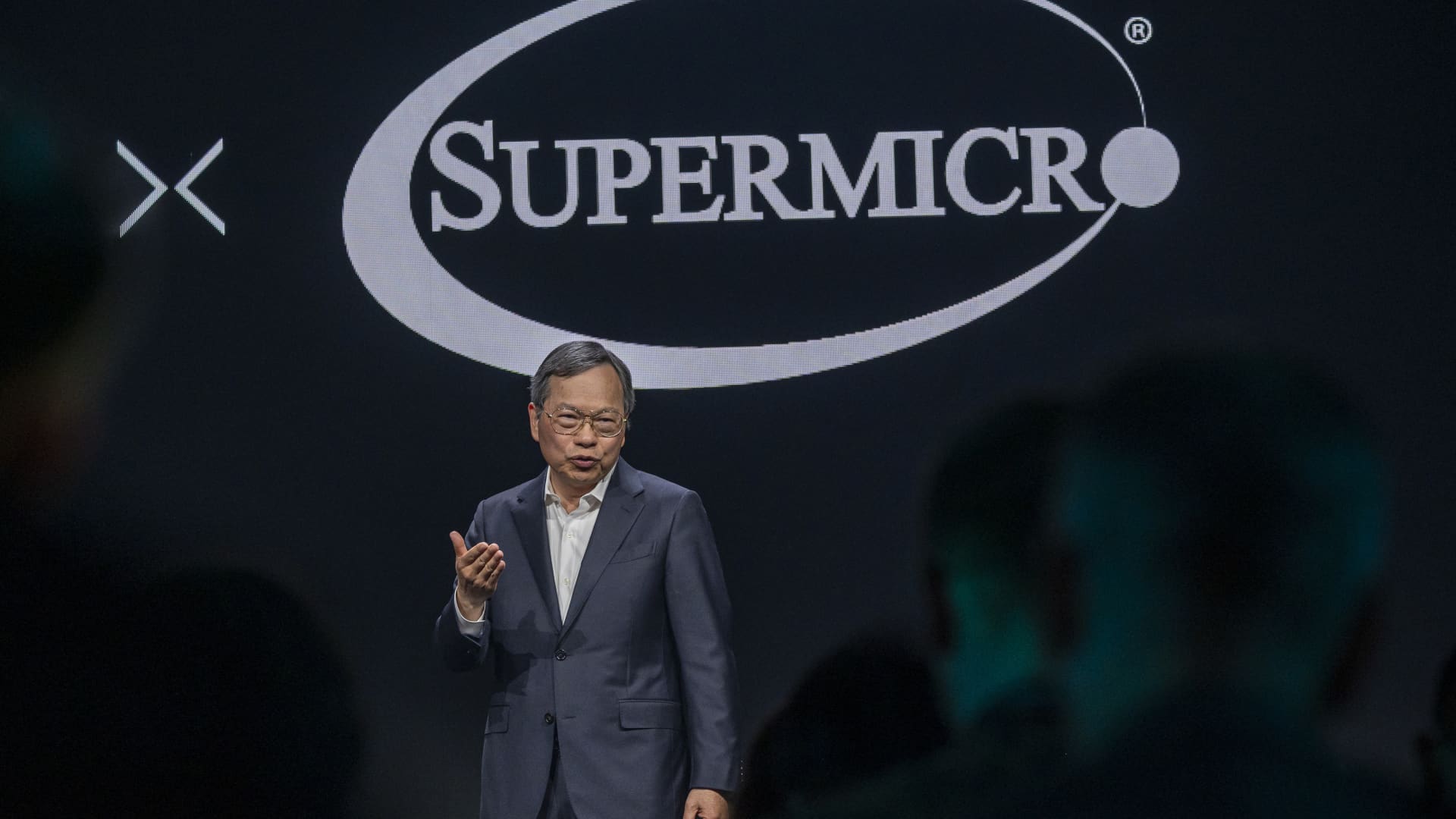

Eric Xu, rotating chairman at Huawei, issued fighting words against Washington’s tech export restrictions on China.

“I believe China’s semiconductor industry will not sit idly by, but take efforts around … self-strengthening and self reliance,” according to an official translation of Xu’s comments during a press conference.

“For Huawei, we will render our support to all such self-saving, self-strengthening and self reliance efforts of the Chinese semiconductor industry.”

Semiconductors have been a flash point in the broader U.S.-China battle for tech supremacy. Over the past few years, Washington has attempted to cut China and Chinese firms off through sanctions and export restrictions.

In 2019, Huawei was put on a U.S. black list called the Entity List, which barred American firms from selling technology to the Chinese company. This included chips for 5G products — where 5G refers to super-fast next-generation mobile networks. Chip restrictions against Huawei were tightened in 2020 and effectively separated it from the latest cutting-edge chips it required for its smartphones.

Washington then introduced broader chip restrictions last year, aiming to deprive Chinese firms of critical semiconductors that could serve artificial intelligence and more advanced applications.

The U.S. is concerned that China could use advanced semiconductors for military purposes.

Huawei’s Xu said these developments could boost, rather than hamper China’s domestic semiconductor industry.

“I believe China’s semiconductor industry will get reborn under such sanctions and realize a very strong and self-reliant industry,” Xu said.

Experts previously told CNBC that the latest round of U.S. restrictions are likely to hurt China’s semiconductor industry. Under the current rules, certain tools or chips that are made using American technology are not allowed to be exported to China.

The nature of the chip supply chain makes this very effective. U.S. tools are used across the chip production process, even if a semiconductor is manufactured in another country.

China’s domestic chip industry relies heavily on foreign technology, and it lacks companies that can match firms in the U.S., Taiwan, Japan and South Korea.

China has made self-reliance a big priority amid the tech battle with the U.S., but experts agree this will prove an extremely difficult feat.

Huawei breakthrough

Chinese firms are now trying to develop tools required for semiconductors domestically.

Last week, Chinese media reported that Xu in a speech said that Huawei and other domestic firms jointly created electronic chip design tools needed to make semiconductors sized at 14 nanometers and above. Xu said those tools will be verified this year, which would allow them to be put into use.

The rotating chairman confirmed that he made this speech, but added those tools will “mean very little” for the Huawei business. It only means that Chinese firms have the design tools required domestically, he said.

The 14 nanometer figure refers to the size of each individual transistor on a chip. The smaller the transistor, the more of them can be packed onto a single semiconductor. Typically, a reduction in nanometer size can yield more powerful and efficient chips.

But Huawei ideally needs chips of a much smaller nanometer size for more advanced applications, which they are currently finding it difficult to obtain. The company is still reeling from the effects of U.S. sanctions — on Friday, it said net profit dropped 69% year-on-year in 2022, marking the biggest decline on record.