Beijing’s regulatory crackdown on the Chinese tech sector began in late 2020, wiping off more than a combined $1 trillion from the country’s biggest companies.

There are now signs that the central government is softening its stance towards internet titans like Alibaba, in a move that could prove positive for Chinese tech stocks.

“The regulatory headwinds that we had in the past two years … that’s now becoming from a headwind to a tailwind,” George Efstathopoulos, portfolio manager at Fidelity International, told CNBC’s “Street Signs Asia” on Wednesday.

On Tuesday, Alibaba announced a major reorganization, looking to split its company into six business units, in an initiative “designed to unlock shareholder value and foster market competitiveness.”

Over the past two years, China’s government has often railed against the “disorderly expansion of capital” of tech firms that have grown into large conglomerates. Part of Alibaba’s announcement noted that these splintered businesses could raise outside capital and even go public, seemingly heading in a contrary direction to Beijing’s concerns.

Efstathopoulos said that the move could indicate a green light from the upper echelons of the Chinese government.

“You have senior leadership blessing for unlocking value, and, to me, that is a fantastic indication where we are now essentially moving from regulation not being the issue that it was,” Efstathopoulos said.

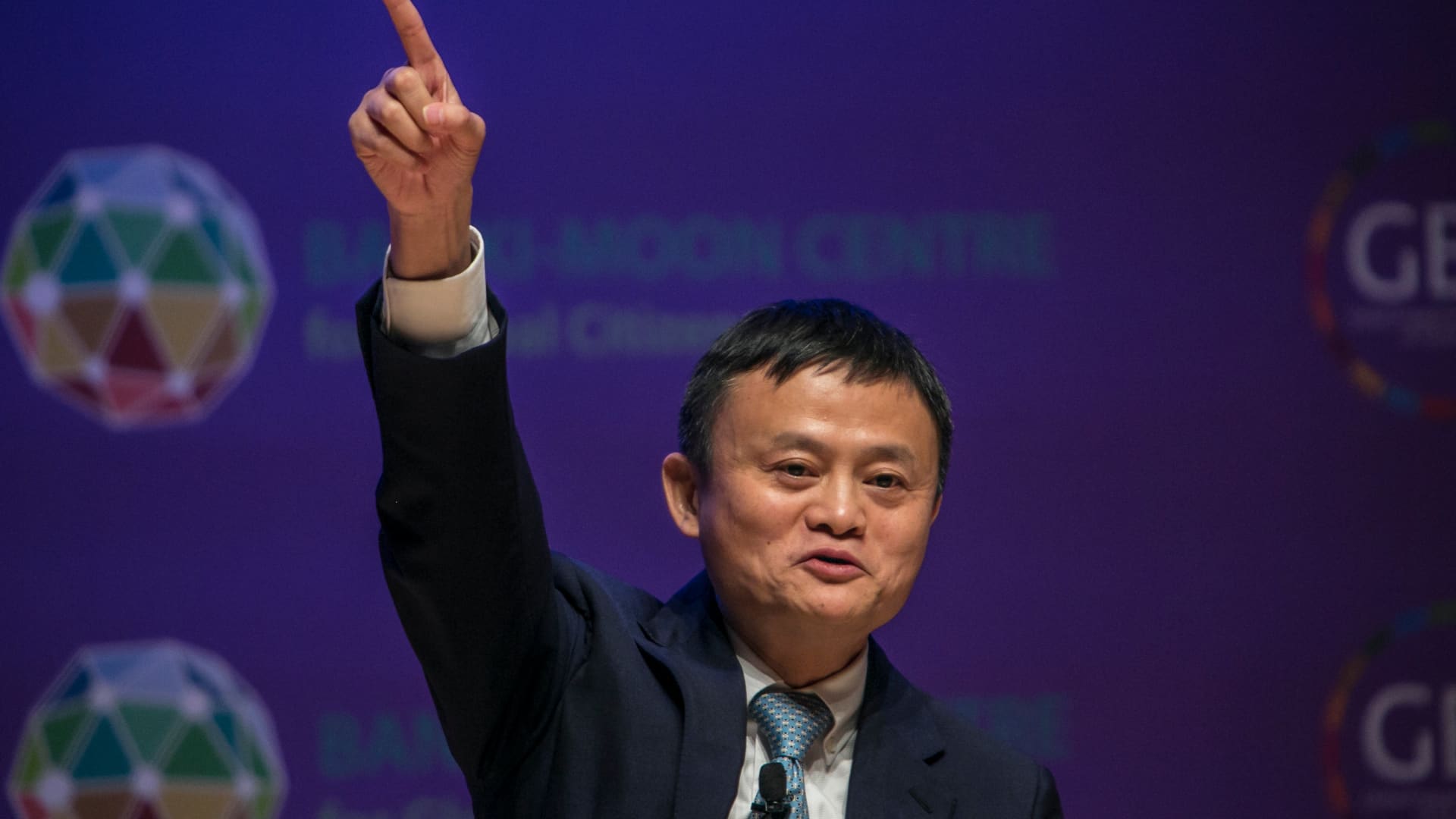

Jack Ma’s return

Alibaba’s restructure isn’t the only sign that Beijing could be easing up its scrutiny of the tech sector. Jack Ma, the founder of Alibaba, returned to public view in China for the first time in months.

Some credit Ma with sparking the start of the tech crackdown in October 2020, when the billionaire made comments that appeared critical of China’s financial regulator. A few days later, Ant Group, the financial technology affiliate of Alibaba that was controlled by Ma, was forced to scrap its massive Hong Kong and Shanghai dual listing, after regulators said it did not meet the requirements to go public.

Following this, the Chinese government doled out huge antitrust fines to Alibaba and food delivery giant Meituan, introducing a slew of regulation in areas from data protection to the way in which companies can use algorithms.

Ma’s reappearance in Hangzhou, where Alibaba is headquartered, has been read as another sign of Beijing’s more positive view toward the tech sector and entrepreneurs.

“Jack just didn’t show up in Hangzhou because he was tired of traveling around. I think it was well orchestrated and fits with the government’s campaign to demonstrate that, you know, they are relaxing pressures on their private sectors and are welcoming the rest of the world,” Stephen Roach, a senior fellow at Yale University, told CNBC’s “Squawk Box Asia” on Tuesday.

Economic growth in focus

There have been further signs of regulatory easing over the past few weeks.

The gaming sector was hard hit in 2021, as authorities grew concerned about addiction among young people in China. Chinese regulators froze the approval of new game releases for several months. Last April, authorities began to green light new games, mainly from domestic firms. This month, the video game licensing regulator gave its stamp of approval to a batch of foreign titles for release in China.

Meanwhile, Chinese ride-hailing giant Didi — one of the companies caught up in the regulatory overhaul — announced plans to expand its business. Didi went public in the U.S. in June 2021, but found itself subjected to a cybersecurity review by Chinese regulators within days of listing. It eventually delisted from the New York Stock Exchange and plans to float in Hong Kong.

Over the last few days, foreign technology executives including Apple CEO Tim Cook and Qualcomm CEO Cristiano Amon visited China and met with government officials.

Jack Ma, founder of Alibaba, reappeared in the public view in China for the first time in months. Alibaba then announced a huge reorganization of its business. Experts see the move as a signal that the Chinese government is softening its stance toward tech giants after a crackdown that began in late 2020.

Jean Chung | Bloomberg | Getty Images

In addition to warming to the domestic tech sector, China is also courting foreign business. Its economy has been battered over the past two years, thanks in part to the country’s strict Covid policies and regulatory tightening. The government now aims for around 5% economic growth this year.

To achieve that, it will need the help of private businesses — including the tech sector.

“China is facing both weak economic growth and rising tech competition from the U.S. It’s a pretty tough position to be in. So they need the economy to fire on all cylinders. Tough regulations on big tech platforms just doesn’t make sense at this juncture,” Linghao Bao, tech analyst at Trivium China, told CNBC via email.

Is China tech out of the woods yet?

While there are promising signs for investors, there is also reason to be cautious, warned Xin Sun, senior lecturer in Chinese and east Asian business at King’s College London.

Sun describes the Alibaba reorganization as a move to “break up Alibaba’s business empire and to reduce its huge influence that could potentially pose a threat” to the Chinese Communist Party’s rule.

“After restructuring, the organizational structure of Alibaba will become more decentralized, and the control over its assets, data and resources will be less concentrated. The Party could then impose stronger political control over each of the new entity more easily,” Sun added.

He cautions against too much optimism around the Chinese technology sector. While the latest moves bring some regulatory certainty, many questions remain about how other tech giants might fare.

“In the short run, Alibaba’s restructuring might be perceived as the routinization of the government regulatory actions and provide some regulatory certainty for the sector,” Sun said.

“In the long run, however, it raises more questions about the fate of other tech giants. Will Tencent, Meituan, and ByteDance be broken up too? If so, do they make their own decisions or do they just wait for the order from the government? Such uncertainty will keep weighing on entrepreneurs and investors, undermining their confidence.”