One of the UK’s most prominent pub chain bosses has issued a rallying cry to the hospitality industry, saying a tax disparity is the biggest threat to its success.

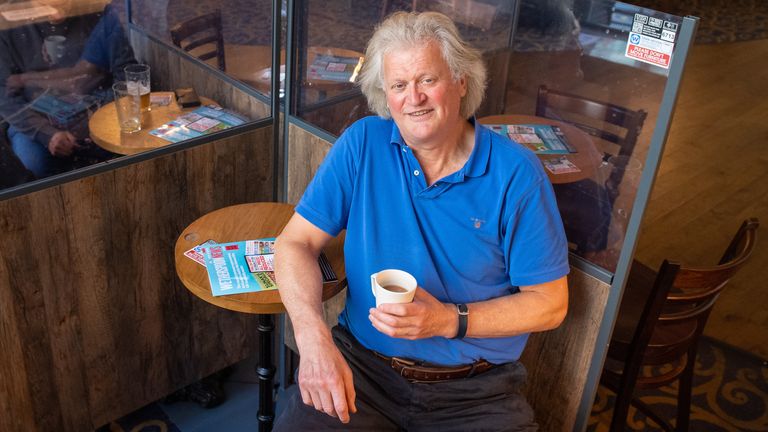

JD Wetherspoon’s chairman, Tim Martin, has long-complained about supermarkets’ treatment when it comes to the payment of Value Added Tax (VAT), saying it gives them an unfair advantage – particularly at a time when the hospitality sector is struggling to recover from the COVID pandemic because of the cost of living crisis.

“Supermarkets pay zero VAT in respect of food sales, whereas pubs and restaurants pay 20%. This tax benefit allows supermarkets to subsidise the selling price of beer,” he wrote.

“We estimate that supermarkets have taken about half of the pub industry’s beer volumes since Wetherspoon started trading in 1979, a process that has likely accelerated following the pandemic.”

He complained: “Pub industry directors have, in general, failed to campaign for tax equality, which is an important principle of taxation.

“Unless the industry campaigns strongly for equality, it will inevitably shrink relative to supermarkets, which will not help high streets, tourism, the economy overall, or the ancient institution of the pub.”

He made his remarks against a backdrop of strong trading for major supermarket chains, which benefited hugely from lockdowns and other pandemic restrictions as pubs and restaurants were forced to shut their doors.

Trading updates since Christmas have largely shown continued sales growth as shoppers eat and drink more at home because of the squeeze on their finances from energy-led inflation.

Mr Martin’s plea was contained in an update to the market on the value-focused chain’s performance.

He said he was “cautiously optimistic” about the current financial year despite its sales for the 25 weeks to 22 January falling below pre-pandemic levels.

Like-for-like sales were 0.7% lower than the corresponding period immediately before COVID.

Performance dropped further – by 2% – in the last 12 weeks, underscoring the hit to trading during the traditionally strong festive season.

Rivals have blamed the surge in living costs and disruption caused by rail strikes.

Wetherspoons, which has more than 900 pubs and hotels, said however that like-for-like sales were 13.1% higher for the 25 weeks from a year earlier.

Shares were more than 2% down in early deals.

Derren Nathan, head of equity research at Hargreaves Lansdown, said: “Wetherspoon’s value offer is helping it to outperform its peers, and the recent steps it’s taken to shore up the balance sheet leave it well placed to ride out the storm.

“As the clouds continue to darken for the hospitality sector, it may be a case of last man standing.

“Wetherspoon will in our opinion no doubt survive, and indeed prosper with increased market share for when the cycle turns. But in the short term, the news could well get worse before it gets better.”