Every week when Linda Glass pays for her weekly shop, she is also overpaying on her mortgage – and is on track to save almost £16,000.

Shopping at Morrisons and spending around £200 – “I have twin teenage boys,” the mum from Lincoln said – she is able to earn £7.48 that goes directly towards her mortgage.

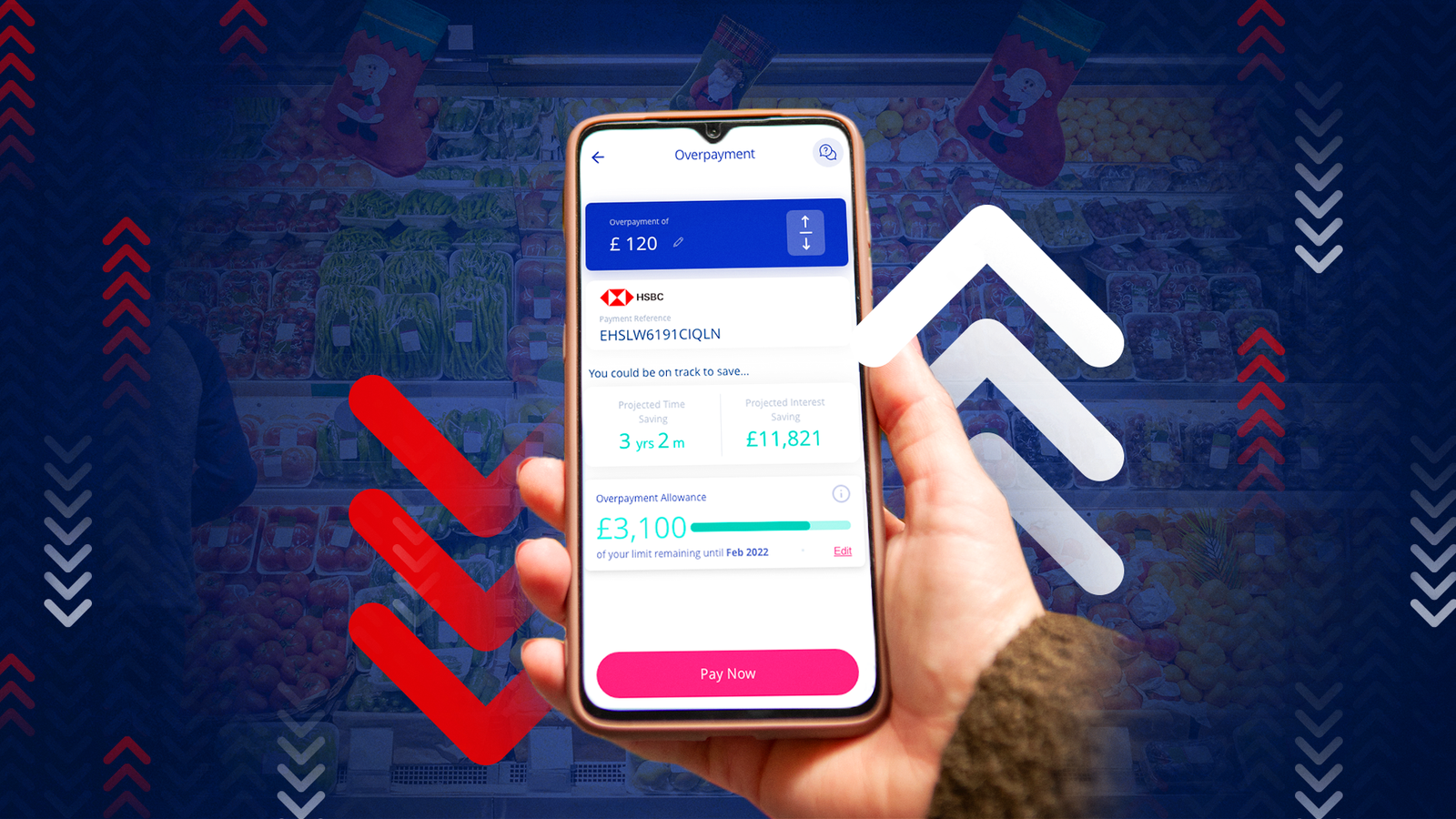

She uses Sprive, an online app that works as a mortgage assistant.

One of the app’s main functions is that, by linking to your bank, it analyses how you spend and makes small payments into an online account, with that money used towards your mortgage.

Cost of living calendar – reveal a different story every day

“I want my money to work harder for me, and I am trying to save in any way I can,” she added.

But now, its latest feature – Shop with Sprive – functions a bit like traditional cashback, but instead the money goes towards making homeowners debt-free quicker.

While it might not seem like a lot, earning an extra £25 a month towards your mortgage can have a huge benefit.

Putting this towards a £250,000 mortgage at 4% for 30 years would save you £7,969.

How Linda will pay off her mortgage four years early

Linda was making regular overpayments of between £25 and £125 a month and was on track to save £7,400 and pay off her mortgage three years and four months earlier.

Now she has started using Shop With Sprive, the additional £30 a month will save her an extra £8,400 and see her pay off her mortgage an additional year and one month earlier.

This means her total savings are almost £16,000 – and she will be finished paying her mortgage four years and five months faster.

So far, the brand has partnered with four supermarkets – Morrisons, Waitrose, M&S and Iceland – a number of food and drink outlets – including Costa and Uber Eats – and home, travel and book retailers.

Linda, 51, said she is quite tech-savvy but likes how easy it is to make overpayments.

For those who think it might be too good to be true, Linda said: “Give it a go. You can always opt out of it. You are not locked into anything if you don’t feel comfortable with it.

“But be open to everything that is there to save you money. Whilst you don’t see it put in your bank account, everyone’s house is their biggest debts hanging around their necks and it will pay off in the long-run.”

Why overpaying your mortgage is a good idea

Interest rates are at their highest in years – so if you can, overpaying on your mortgage should be something you should do. You can save thousands and become debt-free quicker.

You can save such large sums because you aren’t just clearing your debt, but because you pay less in interest.

You can usually pay off up to 10% of your outstanding balance each year without facing an early repayment penalty.

Click to subscribe to the Sky News Daily wherever you get your podcasts

It is almost always better to overpay your mortgage rather than put that money in savings (although an emergency fund is also a good idea before you do this).

For example, according to MoneySavingExpert, £100 extra month would save you £17,082 in interest on a £150,000 mortgage at 4%. If you put that same amount in savings, you’d have £9,585.