Prime Minister Liz Truss’s external adviser on the economy has told Sky News that the chancellor had “taken his eye off the ball” and “overstepped the mark” with his mini-budget.

Gerard Lyons, who is often referred to as Ms Truss’s favourite economist, said Chancellor Kwasi Kwarteng failed to adequately prepare the financial markets ahead of his announcement.

Speaking on The Take With Sophy Ridge, Mr Lyons said: “The chancellor, whilst he had focused on the general public and on British businesses, he had not really prepared the financial markets fully.

“And I think he had taken his eye off the ball slightly, shall we say, in having not prepared the markets for what he was doing in the budget and I felt that he overstepped the mark last week.

“So it was a combination of all three factors – the febrile markets because of the global backdrop, the actions of the Bank of England last Thursday, but let’s be in no doubt, it was primarily the mini-budget last Friday that triggered this latest series of events.”

Asked if he had had any conversations with Ms Truss or her team, Mr Lyons said he had “made my thoughts known”. He said he was “highlighting in my writing… about the febrile state of the markets and the need to keep the markets onside”.

Pushed on whether they had taken his advice, he said: “Well, sometimes people listen, sometimes they don’t, but there were positives that came out of it. But as we saw last Friday, there was just not enough in line with what the markets had been prepped for and were expecting.”

Despite his remarks, Mr Lyons said the budget was “very positive in many respects”.

He said it was “very much on a pro-growth agenda” which was needed to “break out of this low-growth phrase”.

Mr Lyons’s remarks about the chancellor failing to prepare the financial markets were contrasted by a minister who told deputy political editor Sam Coates it was “bulls***t” to say market movement was related to the mini-budget announcement.

And on The Take with Sophy Ridge, chief secretary to the Treasury Chris Philp denied the government had any responsibility and said there would be no change of course.

Read more:

Ed Conway on the Bank’s extraordinary response

Liz Truss is a ‘danger to the economy’, Starmer says

Government departments asked for ‘efficiency savings’

“Getting Britain’s economy growing is so important. Important to raise wages and important to pay the tax bills of the future,” he said.

Mr Philp suggested benefits may not be hiked in line with spiralling inflation. He said a commitment by former chancellor Rishi Sunak to uprate benefits in line with inflation was under consideration amid reports different government departments have been asked to draw up plans for efficiency savings.

Mr Philp told ITV’s Peston: “We are going to look for efficiencies wherever we can find them.”

But he said the Treasury would not commit to an expected uprating of benefits in line with inflation.

Pressed about the decision, he said: “I am not going to make policy commitments on live TV, it is going to be considered in the normal way, we will make a decision and it will be announced I am sure in the first instance to the House of Commons.”

Subscribe to the Daily podcast on Apple Podcasts, Google Podcasts, Spotify, Spreaker

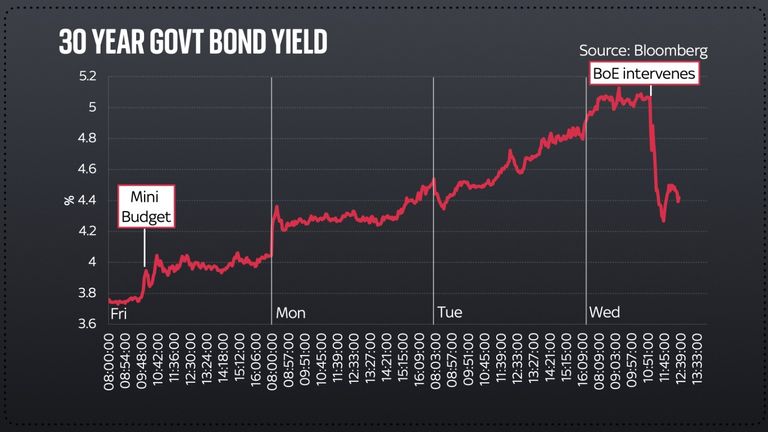

On Wednesday the Bank of England was forced to launch an emergency government bond-buying programme to prevent borrowing costs from spiralling out of control and stave off a “material risk to UK financial stability”.

The Bank will buy as many long-dated government bonds as needed between now and 14 October in a bid to stabilise financial markets.

The announcement had an immediate effect on the market, with data showing 30-year bond yields fell back to 4.3%, having risen to levels above 5% not seen since 2002, earlier on Wednesday. There were similar falls for 20-year yields.

Ms Truss is expected to face public questioning about her economic plans for the first time on Thursday as she tours regional BBC radio stations in a morning round of interviews. Neither the prime minister nor the chancellor were anywhere to be seen or heard on the economy on Wednesday.