The surge in the rate of inflation of the past couple of months showed no sign of slowing in May, hitting 2.1% as the cost of a range of goods picked up following the coronavirus crisis-induced slump for the economy.

Figures from the Office for National Statistics (ONS) showed the annual pace of price growth – as measured by the consumer prices index (CPI) – rose from 1.5% in April.

The pace of the acceleration was faster than economists had predicted, with 1.8% largely expected for May.

The report cited upwards pressure on inflation from transport, motor fuel, clothing and eating out costs.

Experts say it is partly a consequence of a pick up in demand but also reflects shortages of raw materials globally because of COVID-19 disruption.

The figures were released following a warning from the Bank of England’s chief economist that the UK needs an inflation spike “like the plague” because a surge in living costs risks inflicting damage on households and businesses.

His boss, governor Andrew Bailey, has defended the wider Bank’s view that the inflation is “transitory” – a “hump” in prices such as energy costs that will soon settle as times return to normal following an unprecedented shock.

The Bank, which has a 2% target for inflation, could raise interest rates from their record low 0.1% to counter price rises.

However, it is reluctant to inflict higher borrowing costs on the economy as they could also dampen the shaky recovery.

It is a monetary policy debate that is set to intensify following the latest figures.

The CPI measure had stood at just 0.7% in March.

ONS Chief Economist Grant Fitzner said: “The rate of inflation rose again in May and is now above 2% for the first time since the summer of 2019.

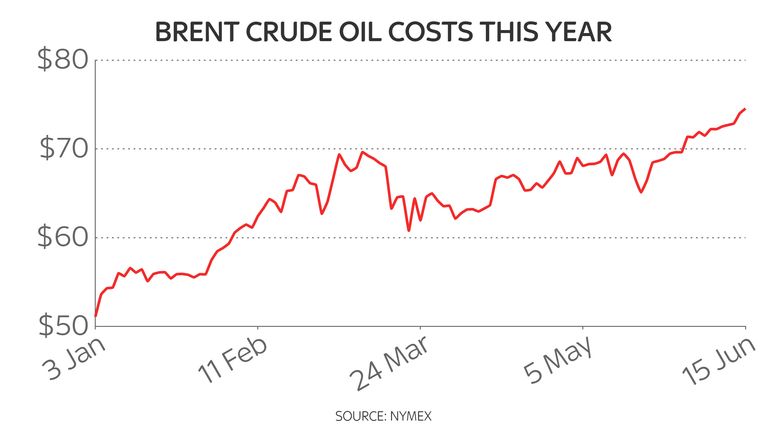

“This month’s rise was led by fuel prices which fell this time last year, but have jumped this year thanks to rising crude prices.

“Clothing prices also added upward pressure as the amount of discounting fell in May.”