EasyJet has said it expects to see a pick-up in demand for flights from June while revealing a £701m loss for the first half of its financial year.

The no-frills airline said its financial performance would have been worse but for a cost-cutting programme that is expecting to deliver £500m in savings over the 12 months to September as the effects of the COVID-19 crisis continue to wreak havoc on the industry.

The underlying loss during the half-year to March compared to a figure of £193m during the same period last year – a time when flight schedules were starting to grind to a halt as the pandemic hit European shores.

Pre-tax losses came in at £645m.

The airline, which is expecting to fly just 15% of its pre-crisis capacity in the current third quarter, reported a surge in bookings of 105,000 when the UK government revealed its so-called green list for international destinations that require testing but no quarantine.

EasyJet is lucky in that it has a heavy exposure to Portugal – included on the list which allowed travel from Monday.

But there has since been confusion, sown by the government, over whether people should be booking, let alone travelling, to amber nations.

The transport secretary told Sky News on Thursday that people should “apply common sense” over travel to those countries, destinations that require an isolation period at home after returning.

EasyJet’s prediction of a pick-up in demand from June is largely based on expectations that the government significantly expands the green list at next month’s review.

It said it was able to use up to 90% of its fleet to meet any surge in demand.

Chief executive Johan Lundgren said: “With leisure travel taking off in the UK again earlier this week where we are the largest operator to green list countries, and with so many European governments easing restrictions to open up travel again, we are ready to significantly ramp up our flying for the summer with a view to maximising the opportunities we see in Europe.”

The company said it had raised £5.5bn of cash during the pandemic to strengthen its liquidity – with net debt quadrupling to £2bn over the past 12 months as a result.

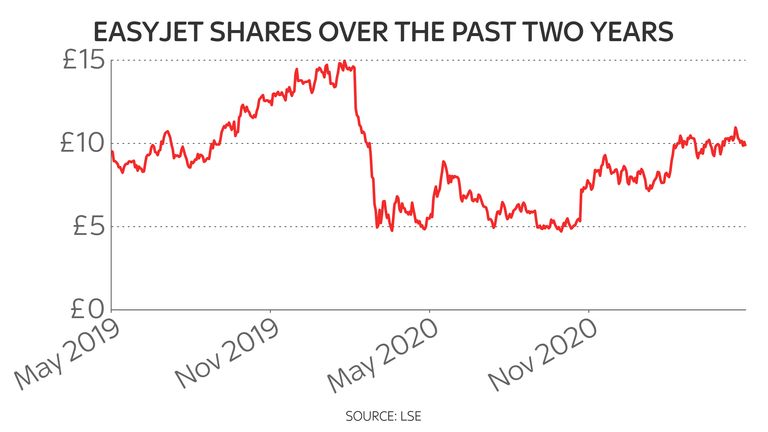

Shares fell almost 1% at the open.

Freetrade analyst David Kimberley said of the company’s position: “The problem for shareholders now becomes the mound of debt the firm has built up during the past 12 months.

“EasyJet has close to seven times as much debt as it did prior to the pandemic and that will undoubtedly eat into future earnings.

“That’s on top of last year’s share placing which, representing close to 20% of the company’s free float, also meant a substantial dilution of shareholder value.

“So even if the more immediate damage the pandemic has caused may soon be over, there are going to be long-lasting consequences that the airline will have to struggle with for years to come.”