The rate of inflation has taken an unexpected plunge on the back of a coronavirus crisis-driven fall in fashion costs – the deepest since 2009.

The Office for National Statistics (ONS) said the consumer prices index (CPI) measure eased to 0.4% in February from 0.7% the previous month.

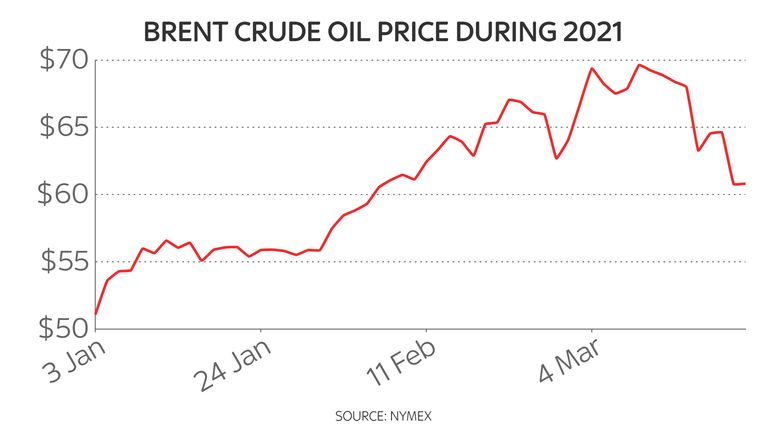

Analysts had expected that higher oil prices – mainly passed on to consumers at the fuel pumps – would stoke a rise in the annual rate to 0.8%.

Live COVID updates from across the UK and around the world

The ONS figures showed that while motor fuels were among the largest contributors to inflation pressure in the month, clothing and footwear costs fell between January and February this year as the COVID-19 pandemic disrupted demand and restrictions forced stores to remain shut.

“This results in a fall in clothing and footwear prices of 5.6% in the year to February 2021 – the largest fall since November 2009”, the ONS said.

Its deputy national statistician for economic statistics, Jonathan Athow, commented: “A fall in clothing prices helped to ease inflation in February, traditionally a month where we would see these prices rise, but the impact of the pandemic has disrupted standard seasonal patterns.

“Elsewhere there were falls in the price of second-hand cars.

“However, prices at the pump rose this month, compared with a fall this time last year.”

A low rate of inflation eases pressure on household budgets at a time when many have been severely squeezed by coronavirus restrictions that has left at least five million remaining on furlough and almost 700,000 out of payrolled employment.

The Bank of England expects inflation to rise sharply back towards its 2% target in the first half of this year, reflecting the rise in Brent crude prices and cap on default tariff household energy prices.

Separate ONS data showed that producer prices – which tend to feed through into consumer prices later – were 2.6% higher than the year before in February.

Ed Monk, associate director for personal investing at Fidelity International, said of the figures: “The fall in inflation confirmed today adds to a confusing picture on prices right now.

“Again, it’s sluggish clothing and footwear prices which have done most to drag the headline rate lower, but that’s in the context of lockdown when spending habits have shifted and retailers have had to adapt their discounting over the past 12 months.

“If restrictions are lifted and those effects fall away, a big brake on price rises will be released.”