The UK economy rediscovered a reverse gear in January as renewed coronavirus lockdowns knocked output while trade suffered a Brexit hit, according to official figures.

The initial estimate of a 2.9% contraction in gross domestic product (GDP) compared with the previous month, from the Office for National Statistics (ONS), was better than the figure of nearer 5% expected by economists.

It followed growth of 1.2% measured for December.

Live COVID updates from the UK and around the world

There was no specific mention in the GDP report of an impact caused by the UK’s departure from the EU, as January marked the end of the Brexit transition period.

However, separate ONS data on trade highlighted the largest monthly fall in goods imports and exports for the UK since records began in January 1997 and sparked a political row in the process.

The ONS charted a 41% decline in exports to the EU during the month – at a value of £5.6bn – alongside a £6.6bn fall in imports from the bloc.

That equated, the report said, to a 29% reduction.

ONS deputy national statistician for economic statistics, Jonathan Athow, said: “The economy took a notable hit in January, albeit smaller than some expected, with retail, restaurants, schools and hairdressers all affected by the latest lockdown.

“Manufacturing also saw its first decline since April with car manufacturing falling significantly.

“However, increases in health services from both vaccine rollout and increased testing partially offset the declines in other industries.

“Both imports and exports to the EU fell markedly in January with much of this likely the result of temporary factors.

“Returns from our more timely surveys and other indicators suggest trading began to recover towards the end of the month.”

The trade figures reflected caution among businesses at the start of January amid confusion over new paperwork at ports and coronavirus testing procedures placed on drivers.

There was also strong evidence of stockpiling in advance of 31 December to avoid possible disruption.

The government said overall freight volumes had returned to normal levels by February and the data should be treated with caution.

But Labour responded by saying that the figures made it clear “just how many British businesses have been struggling with the new reams of costly red tape and bureaucracy this government has wrapped them in.”

The ONS said the toll on activity from coronavirus meant the economy remained 9% below its pre-crisis peak.

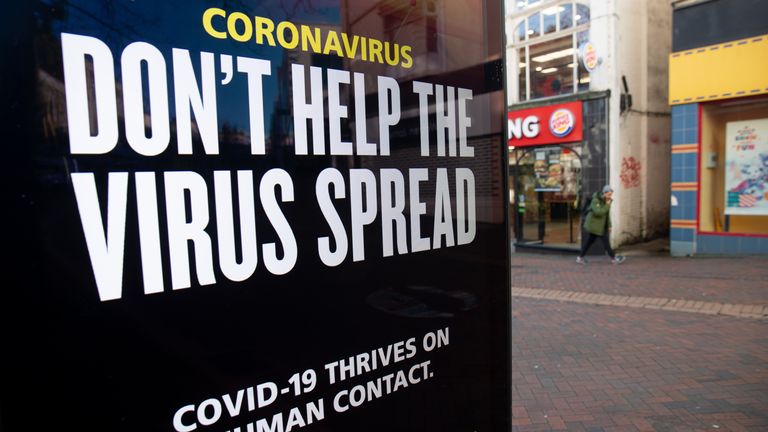

The services sector was hit hardest during January as hospitality and leisure companies were forced to shut down under measures UK-wide to control the spread of the disease.

Chancellor Rishi Sunak said of the data: “Today’s figures highlight the impact the pandemic continued to have on our economy at the start of the year as we tackled the new variant of the virus- and I know this is a cause of concern for many.

“But we also have reasons to be hopeful- we have set out a clear roadmap out of the pandemic, the NHS has vaccinated over 23 million people and my budget last week set out our three part plan to protect the jobs and livelihoods of the British people.

“We will continue to protect jobs and businesses as long as this crisis lasts, we will be honest with people and put the public finances on a more sustainable path, and we will begin the work of building our future economy.”

Economists said the weaker-than-expected contraction reflected the fact that many businesses had adapted but the fact that schools were closed – forcing many parents away from workplaces – inflicted some damage.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said: “More recently, business surveys, timely retail sales data and figures on transport usage show that the economy already has recovered some of the ground lost in January.

“As a result, the quarter-on-quarter decline in GDP in Q1 (first quarter) looks set to be close to 2%.”

Experts largely agree that gradual exits from lockdowns, aided by the UK vaccine programme and continuing support from government schemes including furlough, should avert a recession as activity would be expected to bounce back strongly in the second quarter of the year.